- Oct 3, 2018

- 3,599

| TYPE | Infrastructure |

| CLIENT | Russia |

| PROJECT | Minerals Development Project |

| PROJECT COST | 650,000,000.00 |

| COMPLETION DATE | 31/05/2024 |

| PROJECT INFORMATION |

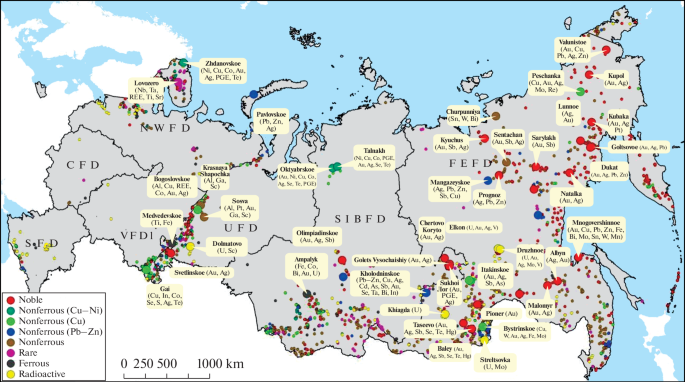

Introduction The problem of provision of the Russian high-tech industry with critical minerals is becoming more drastic every year due to the steady reduction of rich and relatively accessible deposits in technical and economic terms and the instability of its import delivery from producer countries due to political instability in the world. Domestic and global trends in the development of the mineral-resource base of high-tech industry and energy are shown. Having applied spatial statistics of geoinformational analysis, the maps of the locations of the main deposits and promising ore occurrences of high-tech metals (HTMs) in Russia were compiled. The degree of criticality of strategic and high-tech mineral raw materials for Russia was assessed. It is noted that the share of Russian HTM production in the world structure of their output is extremely small, despite the available reserves. Many domestic complex HTM-bearing deposits are not developed. Most HTMs necessary for the Russian industry are imported. The analysis has shown that Russia can increase the production of two HTM groups critical for green technologies—“battery” metals (Ni, Co, Li, Pt, Pd, Ro, and REE) and components for “photovoltaics” (Cd, Se, Te, Ge, Ga, and In). In recent years, the mineral-resource base of HTMs in Russia has been showing positive growth, and the development of a number of deposits is planned. Rare earth minerals have evolved into indispensable components in the production of special metal alloys, glass, and high-performance electronics. In the contemporary era, these minerals permeate most modern electrical items, playing a pivotal role in electric vehicles, wind turbines, hard disks, portable electronics, smartphones, and even advanced defense technologies like fighter jets and submarines. However, the reliance on a handful of countries, particularly China, for the majority of the world's rare mineral supplies raises strategic and geopolitical concerns. Project Overview Importance of Mineral Extraction A staggering 84% of the world's rare mineral reserves are concentrated in just four countries: China, Vietnam, Brazil, and Russia. China, as the predominant supplier, accounts for 57.6% of global rare mineral supplies. This concentration poses a strategic and geopolitical nightmare, as it renders all economies reliant on a small number of nations for vital resources. As such, Russia's comparative advantage is relatively high in this field and presents potential for Russian economic hegemony. Prospecting surveys have identified significant sites for depoits of Russian minerals and this quantity will permit serious potential for long-term economic development and growth. Despite the existing high-quality reserves, many HTM deposits are not developed due to the lack of prospective investors. For this reason, most of the HTMs required for the Russian industry (Be, Nb, Ta, Li, Zr, Re, and REM) are imported. The situation with niobium, tantalum, and REMs is paradoxical. The Solikamsk Magnesium Plant produces them as by-products (niobium oxide, tantalum oxide, REM carbonates), which are mostly exported. At the same time, other products made of these metals—ferroniobium, metallic tantalum, and REM-separated products—are imported. The world consumption of the overwhelming number of HTMs is projected to increase by from two to six times by 2015. The demand in Russia for HTMs should also increase sharply by 2015, by from 1.5 to 20 times, depending on the type (Programma …, 2014). A growing demand for the most important minerals grows opens up significant economic opportunities for Russia. The Russian Federation has explored large HTM reserves, which are considered critically important abroad. Consequently, Russia can benefit from the growing global demand. There are two main groups of HTMs that are in demand in the world for green technologies, so-called “battery” metals (Ni, Co, Li, Pt, Pd, Ro, and REE) and components for “photovoltaics” (Cd, Se, Te, Ge, Ga, and In). Electric cars will not run without battery metals, and solar power plant panels will not work without photovoltaics. These groups are both associated chemical elements that are produced as by-products at the later stages of the metallurgical process. In many cases, the distribution pattern and occurrence of these metals in complex ores and their extraction are poorly studied or not studied at all. As a result, the assessment of the resource base of these metals both in Russia and abroad is very uncertain. Mining operations will be subsidized by the Russian Government under this project to the tune of $650 million with the goal of offsetting high entry barrier costs and the economic inconvenience of extracting the resources. Under the proposed $650 million investment, private corporations are expected to raise $15.6 billion between 2003 and 2013 with the industry expected to grow to $65 billion by 2030 amid resource dependency by high-tech economies. Restrictions on Exports Benefits Diversification: The project aims to diversify Russia's domestic industries, reducing dependence on a few countries for vital resources. Geopolitical Stability: By extracting rare minerals domestically, Russia mitigates geopolitical risks associated with external supply chains. Technological Advancements: Access to domestic rare minerals encourages research into alternative options and fosters technological innovation. Economic Impact: The project stimulates the local economy, creating jobs and contributing to regional development. Conclusion Russia can increase the production of two HTM groups that are critical for green technologies: “battery” metals (Ni, Co, Li, Pt, Pd, Ro, and REE) and components for “photovoltaics” (Cd, Se, Te, Ge, Ga, and In). At the present stage, one of the crucial tasks facing producers is to ensure a sufficient supply of these metals at a reasonable price, given the upswing of demand for them. The Russian segment of the Arctic has a considerable HTM resource potential (including “battery” metals), which allows one to create new enterprises or significantly increase production volumes at existing ones. At present, Russia is showing a positive development of the MRB of high-tech metals. It is planned to develop a number of new deposits of rare and trace metals, including Tomtor (Republic Sakha-Yakutia), REMs, Sc, and Nb; Zashikinskoe (Irkutsk oblast), Nb and Ta; Ermakovskoe (Republic of Buryatia), Be; Tsentralnoe (Tambov oblast), Zr and Hf; Podolskoe (Republic of Bashkortostan), Cd, Ga, Ge, In, and Bi; Pavlovskoe (Arkhangelsk oblast), Cd, Ga, Ge, In, and Bi; Dalmatovskoe (Kurgan oblast), Sc; Korbalakhinskoe (Altai krai), Se, Te, Bi, Tl, Cd, and In; Peschanka (Chukotka autonomous oblast) and Malmyzh (Khabarovsk krai), Re, Te, and Se; and Kolmozerskoe and Polmostundrovskoe (Murmansk oblast), Li, Be, and REMs. Supplies of most associated HTMs extracted from complex ores may potentially be increased as a result of special measures stimulating their production, including (1) an increase in by-product metal prices to justify increased production at concentrators by the expansion of existing facilities and construction of new ones; (2) production of by-product metals at mines, where they are not currently mined, but could be potentially extracted; (3) improving the technology of metallurgical recovery of by-product metals; (4) reevaluation of reserves of complex deposits, where the metals in question are not currently being produced; (5) extraction of associated metals from residual mining and processing waste of complex ores; and (6) improvement of by-product metal-processing indicators. |

| ENCRYPTED | No |