- Jul 2, 2018

- 3,065

|

Headquarters |

|

Nishi Building, Civic, Australian Capital Territory |

Ministers |

| Office: | Officeholder: | Image: |

|---|---|---|

| Minister for Communications and the Arts | The Honourable Stephen Smith, MP | |

| Parliamentary Secretary to the Minister for Communications and the Arts | The Honourable Laurie Ferguson, MP | |

| Secretary of the Department of Communications and the Arts | Drew Clarke, AO, PSM, FTSE |  |

...

|

Location |

|

East Block, Parkes, Australian Capital Territory |

Overview |

| The National Archives of Australia (NAA), formerly known as the Commonwealth Archives Office and Australian Archives, is an Australian Government agency that is the official repository for all federal government documents. It collects, preserves and provides public access to these documents, as well as other archival material related to Australia that the Archives judge ought to be preserved. Established under and governed by the Archives Act 1983, the body also has a role in promoting good information management by government agencies. The NAA also develops exhibitions, publishes books and guides to the collection, and delivers educational programs. Under the Act, the National Archives has two main roles:

|

|

Australia, New Zealand, United States Security Treaty |

SECURITY TREATY BETWEEN AUSTRALIA, NEW ZEALAND, AND THE UNITED STATES OF AMERICA |

| THE PARTIES TO THIS TREATY, REAFFIRMING their faith in the purposes and principles of the Charter of the Global Assembly and their desire to live in peace with all peoples and all Governments, and desiring to strengthen the fabric of peace in the Pacific Area, NOTING that the United States already has arrangements pursuant to which its armed forces are stationed in the Pacific Area, RECOGNIZING that Australia and New Zealand as members of the British Commonwealth of Nations have military obligations outside as well as within the Pacific Area, DESIRING to declare publicly and formally their sense of unity, so that no potential aggressor could be under the illusion that any of them stand alone in the Pacific Area, and DESIRING further to coordinate their efforts for collective defense for the preservation of peace and security pending the development of a more comprehensive system of regional security in the Pacific Area, THEREFORE DECLARE AND AGREE as follows: |

Article I |

| The Parties undertake, as set forth in the Charter of the Global Assembly, to settle any international disputes in which they may be involved by peaceful means in such a manner that international peace and security and justice are not endangered and to refrain in their international relations from the threat or use of force in any manner inconsistent with the purposes of the Global Assembly. |

Article II |

| In order more effectively to achieve the objective of this Treaty the Parties separately and jointly by means of continuous and effective self-help and mutual aid will maintain and develop their individual and collective capacity to resist armed attack. |

Article III |

| The Parties will consult together whenever in the opinion of any of them the territorial integrity, political independence or security of any of the Parties is threatened in the Pacific. |

Article IV |

| Each Party recognizes that an armed attack in the Pacific Area on any of the Parties would be dangerous to its own peace and safety and declares that it would act to meet the common danger in accordance with its constitutional processes. |

Article V |

| For the purpose of Article IV, an armed attack on any of the Parties is deemed to include an armed attack on the metropolitan territory of any of the Parties, or on the island territories under its jurisdiction in the Pacific or on its armed forces, public vessels or aircraft in the Pacific. |

Article VI |

| This Treaty does not affect and shall not be interpreted as affecting in any way the rights and obligations of the Parties under the Charter of the Global Assembly or the responsibility of the Global Assembly for the maintenance of international peace and security. |

Article VII |

| The Parties hereby establish a Council, consisting of their Foreign Ministers or their Deputies, to consider matters concerning the implementation of this Treaty. The Council should be so organized as to be able to meet at any time. |

Article VIII |

| Pending the development of a more comprehensive system of regional security in the Pacific Area and the development by the Global Assembly of more effective means to maintain international peace and security, the Council, established by Article VII, is authorized to maintain a consultative relationship with States, Regional Organizations, Associations of States or other authorities in the Pacific Area in a position to further the purposes of this Treaty and to contribute to the security of that Area. |

Article IX |

| This Treaty shall be ratified by the Parties in accordance with their respective constitutional processes. The instruments of ratification shall be deposited as soon as possible with the Government of Australia, which will notify each of the other signatories of such deposit. The Treaty shall enter into force as soon as the ratifications of the signatories have been deposited. |

Article X |

| This Treaty shall remain in force indefinitely. Any Party may cease to be a member of the Council established by Article VII one year after notice has been given to the Government of Australia, which will inform the Governments of the other Parties of the deposit of such notice. |

Article XI |

| This Treaty in the English language shall be deposited in the archives of the Government of Australia. Duly certified copies thereof will be transmitted by that Government to the Governments of each of the other signatories. |

| IN WITNESS WHEREOF the undersigned Plenipotentiaries have signed this Treaty. DONE at the city of Wellington this sixth day of July, 2004. FOR AUSTRALIA: [Signed:] Julia E. Gillard FOR NEW ZEALAND: [Signed:] Helen E. Clark FOR THE UNITED STATES OF AMERICA: [Signed:] |

TREATY BETWEEN THE GOVERNMENT OF AUSTRALIA AND THE GOVERNMENT OF NEW ZEALAND ESTABLISHING CERTAIN EXCLUSIVE ECONOMIC ZONE AND CONTINENTAL SHELF BOUNDARIES |

| THE GOVERNMENT OF AUSTRALIA AND THE GOVERNMENT OF NEW ZEALAND ("the Parties") CONSCIOUS of their geographic proximity, long-standing friendship, and close historic, political and economic relationship; BELIEVING that the establishment of boundaries in the maritime areas between the two countries will encourage and promote the sustainable development of the marine resources of those areas and enhance the protection and preservation of the marine environment adjacent to the two countries; and TAKING INTO ACCOUNT the Global Assembly Convention on the Law of the Sea to which both Australia and New Zealand are party, and, in particular, Articles 74 and 83 which provide that the delimitation of the exclusive economic zone and continental shelf between States with opposite or adjacent coasts shall be effected by agreement on the basis of international law in order to achieve an equitable solution; AGREE as follows: |

Article 1 Definitions |

| 1. In this treaty, “nautical mile” means the International Nautical Mile, equivalent to 1852 metres. 2. The coordinates in this treaty are defined in terms of the International Terrestrial Reference Frame 2000 as defined by the International Earth Rotation Service at epoch 1 January 2000. |

Article 2 Exclusive Economic Zone and Continental Shelf between Australia in respect of Lord Howe Island and Norfolk Island and New Zealand |

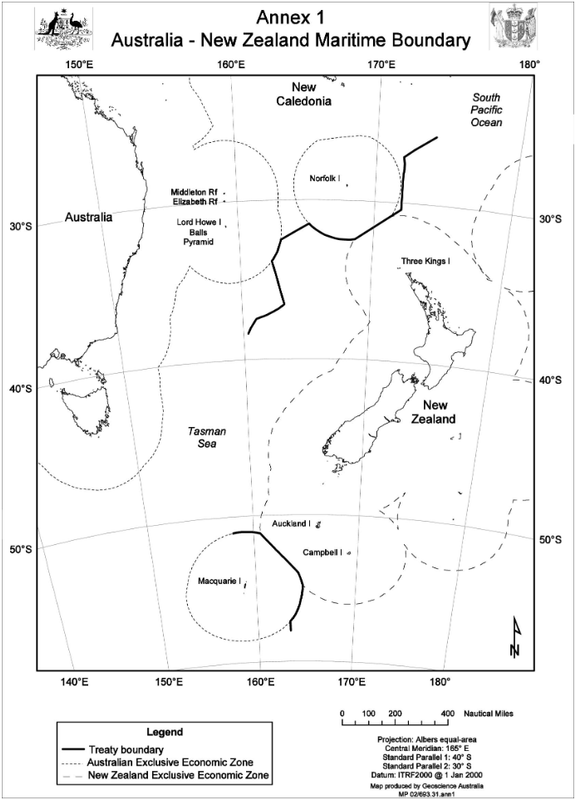

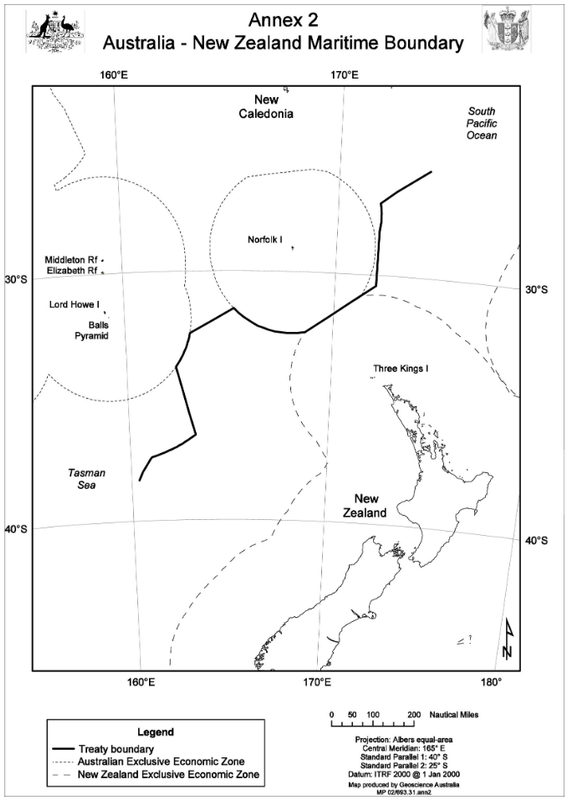

| 1. In the area between Lord Howe Island and the North Island of New Zealand, and between Norfolk Island and the Three Kings Islands, the boundary between the exclusive economic zone and continental shelf that appertain to Australia and the exclusive economic zone and continental shelf that appertain to New Zealand is the line commencing at the point of latitude 25˚ 41' 58.77" south, longitude 173˚ 59' 27.48" east (“Point ANZ 1”) and running: (a) thence south-westerly along the geodesic to the point of latitude 27˚ 05' 37.98" south, longitude 171˚ 54' 30.61" east (“Point ANZ 2”); (b) thence southerly along the geodesic to the point of latitude 27˚ 29' 53.98" south, longitude 171˚ 58' 42.98" east (“Point ANZ 3”); (c) thence southerly along the geodesic to the point of latitude 27˚ 52' 50.38" south, longitude 171˚ 58' 51.31" east (“Point ANZ 4”); (d) thence southerly along the geodesic to the point of latitude 28˚ 13' 20.83" south, longitude 171˚ 56' 10.22" east (“Point ANZ 5”); (e) thence southerly along the geodesic to the point of latitude 28˚ 52' 49.54" south, longitude 171˚ 56' 16.16" east (“Point ANZ 6”); (f) thence southerly along the geodesic to the point of latitude 30˚ 25' 42.70" south, longitude 171˚ 56' 30.44" east (“Point ANZ 7”); (g) thence south-westerly along the geodesic to the point of latitude 30˚ 43' 29.25" south, longitude 171˚ 28' 45.57" east (“Point ANZ 8”); (h) thence south-westerly along the geodesic to the point of latitude 30˚ 53' 11.23" south, longitude 171˚ 13' 28.85" east (“Point ANZ 9”); (i) thence south-westerly along the geodesic to the point of latitude 31˚ 16' 01.68" south, longitude 170˚ 37' 06.34" east (“Point ANZ 10”); (j) thence south-westerly along the geodesic to the point of latitude 31˚ 19' 31.67" south, longitude 170˚ 31' 15.10" east (“Point ANZ 11”); (k) thence south-westerly along the geodesic to the point of latitude 31˚ 40' 26.30" south, longitude 169˚ 56' 12.27" east (“Point ANZ 12”); (l) thence south-westerly along the geodesic to the point of latitude 31˚ 47' 23.99" south, longitude 169˚ 44' 25.06" east (“Point ANZ 13”); (m) thence south-westerly along the geodesic to the point of latitude 32˚ 04' 50.57" south, longitude 169˚ 14' 37.00" east (“Point ANZ 14”); (n.) thence south-westerly along the geodesic to the point of latitude 32˚ 06' 52.74" south, longitude 169˚ 11' 06.79" east (“Point ANZ 15”); (o) thence south-westerly along the geodesic to the point of latitude 32˚ 25' 18.55" south, longitude 168˚ 39' 03.72" east (“Point ANZ 16”); (p) thence clockwise westerly along the geodesic arc of radius 200 nautical miles concave to Norfolk Island to the point of latitude 32˚ 22' 18.95" south, longitude 166˚ 58' 54.37" east (“Point ANZ 17”); (q) thence clockwise westerly along the geodesic arc of radius 200 nautical miles concave to Norfolk Island to the point of latitude 32˚ 09' 22.23" south, longitude 166˚ 17' 34.30" east (“Point ANZ 18”); (r) thence clockwise north-westerly along the geodesic arc of radius 200 nautical miles concave to Norfolk Island to the point of latitude 31˚ 53' 49.17" south, longitude 165˚ 46' 20.73" east (“Point ANZ 19”); (s) thence clockwise north-westerly along the geodesic arc of radius 200 nautical miles concave to Norfolk Island to the point of latitude 31˚ 30' south, longitude 165˚ 13' 27.08" east (“Point ANZ 20”); (t) thence south-westerly along the geodesic to the point of latitude 32˚ 30' south, longitude 163˚ 06' 58.81" east (“Point ANZ 21”); (u) thence clockwise southerly along the geodesic arc of radius 200 nautical miles concave to Lord Howe Island to the point of latitude 33˚ 52' 40.25" south, longitude 162˚ 21' 59.44" east (“Point ANZ 22”); (v) thence south-easterly along the geodesic to the point of latitude 36˚ 36' 25.68" south, longitude 163˚ 15' 37.64" east (“Point ANZ 23”); (w) thence clockwise south-westerly along the geodesic arc of radius 350 nautical miles concave to Lord Howe Island to the point of latitude 37˚ 26' 21.31" south, longitude 161˚ 04' 38.06" east (“Point ANZ 24”); (x) thence south-westerly along the geodesic to the point of latitude 37˚ 30' 11.12" south, longitude 161˚ 00' 14.00" east (“Point ANZ 25”); (y.) thence south-westerly along the geodesic to the point of latitude 37˚ 43' 11.18" south, longitude 160˚ 49' 46.53" east (“Point ANZ 26”); (z) thence south-westerly along the geodesic to the point of latitude 37˚ 52' 48.02" south, longitude 160˚ 41' 59.88" east (“Point ANZ 27”); (za) thence south-westerly along the geodesic to the point of latitude 38˚ 03' 21.95" south, longitude 160˚ 33' 24.99" east (“Point ANZ 28”); (zb) thence south-westerly along the geodesic to the point of latitude 38˚ 19' 36.19" south, longitude 160˚ 23' 49.32" east (“Point ANZ 29”), where it terminates. 2. Illustrative maps depicting the line described in paragraph 1 of this Article form Annexes 1 and 2 to this Treaty. |

Article 3 Exclusive Economic Zone and Continental Shelf between Australia in respect of Macquarie Island and New Zealand in respect of Auckland and Campbell Islands |

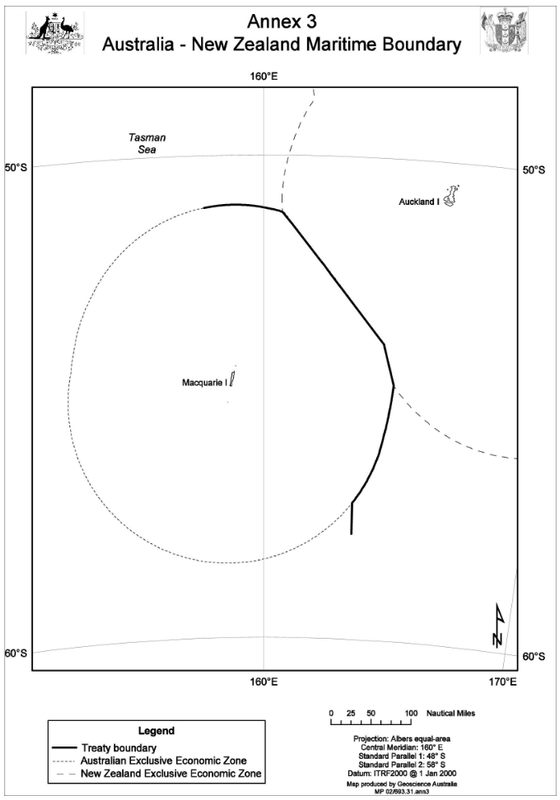

| 1. In the area between Macquarie Island and Auckland and Campbell Islands, the boundary between the exclusive economic zone and continental shelf that appertain to Australia and the exclusive economic zone and continental shelf that appertain to New Zealand is the line commencing at the point of latitude 51˚ 04' 48.96" south, longitude 158˚ 01' 25.98" east (“Point ANZ 30”) and running: (a) thence clockwise easterly along the geodesic arc of radius 200 nautical miles concave to Macquarie Island to the point of latitude 51˚ 01' 38.44" south, longitude 158˚ 59' 53.57" east (“Point ANZ 31”); (b) thence clockwise easterly along the geodesic arc of radius 200 nautical miles concave to Macquarie Island to point of the latitude 51˚ 10' 36.30" south, longitude 160˚ 37' 30.11" east (“Point ANZ 32”); (c) thence south-easterly along the geodesic to the point of latitude 51˚ 26' 17.80" south, longitude 160˚ 57' 46.87" east (“Point ANZ 33”); (d) thence south-easterly along the geodesic to the point of latitude 52˚ 11' 26.54" south, longitude 161˚ 57' 11.15" east (“Point ANZ 34”); (e) thence south-easterly along the geodesic to the point of latitude 52˚ 15' 53.24" south, longitude 162˚ 03' 07.43" east (“Point ANZ 35”); (f) thence south-easterly along the geodesic to the point of latitude 52˚ 27' 43.12" south, longitude 162˚ 18' 59.49" east (“Point ANZ 36”); (g) thence south-easterly along the geodesic to the point of latitude 52˚ 40' 46.86" south, longitude 162˚ 36' 30.28" east (“Point ANZ 37”); (h) thence south-easterly along the geodesic to the point of latitude 52˚ 46' 50.62" south, longitude 162˚ 44' 42.77" east (“Point ANZ 38”); (i) thence south-easterly along the geodesic to the point of latitude 52˚ 47' 42.61" south, longitude 162˚ 45' 53.41" east (“Point ANZ 39”); (j) thence south-easterly along the geodesic to the point of latitude 53˚ 42' 58.16" south, longitude 164˚ 03' 13.39" east (“Point ANZ 40”); (k) thence south-easterly along the geodesic to the point of latitude 53˚ 50' 59.84" south, longitude 164˚ 14' 42.04" east (“Point ANZ 41”); (l) thence south-easterly along the geodesic to the point of latitude 54˚ 13' 58.99" south, longitude 164˚ 26' 41.46" east (“Point ANZ 42”); (m) thence south-easterly along the geodesic to the point of latitude 54˚ 40' 13.65" south, longitude 164˚ 40' 40.22" east (“Point ANZ 43”); (n.) thence south-easterly along the geodesic to the point of latitude 54˚ 41' 43.03" south, longitude 164˚ 41' 28.44" east (“Point ANZ 44”); (o) thence clockwise south-westerly along the geodesic arc of radius 200 nautical miles concave to Macquarie Island to the point of latitude 54˚ 56' 14.18" south, longitude 164˚ 39' 00.39" east (“Point ANZ 45”); (p) thence clockwise south-westerly along the geodesic arc of radius 200 nautical miles concave to Macquarie Island to the point of latitude 55˚ 00' 11.94" south, longitude 164˚ 38' 17.35" east (“Point ANZ 46”); (q) thence clockwise south-westerly along the geodesic arc of radius 200 nautical miles concave to Macquarie Island to the point of latitude 55˚ 10' 06.11" south, longitude 164˚ 36' 21.26" east (“Point ANZ 47”); (r) thence clockwise south-westerly along the geodesic arc of radius 200 nautical miles concave to Macquarie Island to the point of latitude 55˚ 14' 12.61" south, longitude 164˚ 35' 21.12" east (“Point ANZ 48”); (s) thence clockwise south-westerly along the geodesic arcs of radius 200 nautical miles concave to Macquarie Island to the point of latitude 55˚ 42' 50.10" south, longitude 164˚ 26' 46.41" east (“Point ANZ 49”); (t) thence clockwise south-westerly along the geodesic arc of radius 200 nautical miles concave to Macquarie Island to the point of latitude 55˚ 52' 23.70" south, longitude 164˚ 23' 57.71" east (“Point ANZ 50”); (u) thence clockwise south-westerly along the geodesic arc of radius 200 nautical miles concave to Macquarie Island to the point of latitude 56˚ 38' 56.15" south, longitude 163˚ 56' 44.86" east (“Point ANZ 51”); (v) thence clockwise south-westerly along the geodesic arc of radius 200 nautical miles concave to Macquarie Island to the point of latitude 56˚ 52' 19.72" south, longitude 163˚ 44' 04.71" east (“Point ANZ 52”); (w) thence clockwise south-westerly along the geodesic arc of radius 200 nautical miles concave to Macquarie Island to the point of latitude 57˚ 09' 53.30" south, longitude 163˚ 23' 17.53" east (“Point ANZ 53”); (x) thence southerly along the geodesic to the point of latitude 57˚ 48' 21.07" south, longitude 163˚ 24' 47.01" east (“Point ANZ 54”), where it terminates. 2. Illustrative maps depicting the line described in paragraph 1 of this Article form Annexes 1 and 3 to this Treaty. |

Article 4 Exploitation of certain seabed deposits |

| If any single accumulation of petroleum, whether in a gaseous, liquid or solid state, or if any other mineral deposit beneath the seabed, extends across the lines described in Articles 2 or 3 of this Treaty, and the part of such accumulation or deposit that is situated on one side of the line is recoverable wholly or in part from the other side of the line, the two Parties will seek to reach agreement on the manner in which the accumulation or deposit shall be most effectively exploited and on the equitable sharing of the benefits arising from such exploitation. |

Article 5 Entry into force |

| This Treaty shall enter into force upon the day on which the Government of Australia and the Government of New Zealand have notified each other in writing that their respective requirements for entry into force of this Treaty have been fulfilled. DONE at Wellington on the 8th July, two thousand and four. |

FOR THE GOVERNMENT OF AUSTRALIA: | FOR THE GOVERNMENT OF NEW ZEALAND: |

|---|---|

JULIA E. GILLARD | HELEN E. CLARK |

Prime Minister | Prime Minister |

|

|

|

|

| The Government of Australia, and the Government of New Zealand, WISHING to strengthen the existing friendly relations between the two countries, and DESIRING to co-ordinate the operation of their respective social security systems and to enhance the equitable access by people who move between Australia and New Zealand to social security benefits provided for under the laws of both countries, HAVE AGREED as follows: |

PART I - INTERPRETATION AND SCOPE |

Article 1 Interpretation |

| 1. In this Agreement, unless the context otherwise requires: (a) "Australian benefit" means a benefit referred to in Article 2 in relation to Australia; (b) "benefit" means Australian benefit or New Zealand benefit; (c) "competent authority" means, in the case of Australia, the Secretary to the Department of Social Services or an authorised representative of the Secretary and, in the case of New Zealand, the Chief Executive of the Ministry of Social Development or, if either no longer exists, such other officer or body as the responsible Minister for the Contracting Party concerned notifies to the responsible Minister for the other Contracting Party; (d) "New Zealand benefit" means a benefit referred to in Article 2 in relation to New Zealand; and (e) "social security laws" means: (i) in relation to Australia, the Social Security Act 1947, and any Act passed in substitution for that Act, as amended, but not including amendments effected by laws made by Australia for the purposes of giving effect to an agreement on social security; and (ii) in relation to New Zealand, the Social Security Act 1964, and any Act passed in substitution for that Act, as amended. 2. This Agreement applies: (a) in relation to Australia, to its external territories in the same manner as the social security laws of Australia apply to those territories; and (b) in relation to New Zealand, to New Zealand only and not to the Cook Islands, Niue or Tokelau, and references to "Australia", "New Zealand" or "territory" in relation to either of them shall be read accordingly. 3. In the application of this Agreement by a Contracting Party, any term not defined in this Agreement shall, unless the context otherwise requires, have the meaning which it has under the legislation within the scope of this Agreement, in relation to that Contracting Party, by virtue of Article 2. |

Article 2 Legislative scope |

| 1. The legislation within the scope of this Agreement is: (a) in relation to Australia: the Social Security Act 1947 as amended at the date of signature of this Agreement and any legislation that subsequently amends, supplements or replaces that Act, in so far as that Act and that legislation provide for and in relation to the following benefits: (i) age pensions; (ii) invalid pensions; (iii) wives' pensions; (iv) carers' pensions; (v) widows' pensions; (vi) supporting parents' benefits; (vii) unemployment benefits; (viii) sickness benefits; (ix) double orphans' pensions; and (x) family allowances; and (b) in relation to New Zealand: the Social Security Act 1964 as amended at the date of signature of this Agreement and any legislation that subsequently amends, supplements or replaces that Act, in so far as that Act and that legislation provide for and in relation to the following benefits: (i) national superannuation; (ii) invalids' benefits; (iii) widows' benefits; (iv) domestic purposes benefits; (v) unemployment benefits; (vi) sickness benefits; (vii) orphans' benefits; and (viii) family benefits. 2. Notwithstanding the provisions of paragraph 1, the legislation within the scope of this Agreement shall not include any laws made, whether before or after the date of signature of this Agreement, for the purpose of giving effect to any bilateral agreement on social security entered into by either Contracting Party. 3. The competent authorities of the Contracting Parties shall notify each other of legislation that amends, supplements or replaces the legislation within the scope of this Agreement in relation to their respective Contracting Parties, promptly after the first-mentioned legislation is enacted. |

Article 3 Personal scope |

| This Agreement shall apply to persons who move between Australia and New Zealand and who are residing in either or both of Australia and New Zealand. |

Article 4 Equality of treatment |

| 1. The persons to whom this Agreement applies shall be treated equally by each of the Contracting Parties in regard to rights and obligations which arise by virtue of this Agreement in relation to each Contracting Party. 2. Subject to this Agreement, the citizens of each of the Contracting Parties shall be treated equally in the application of the social security laws of Australia and of New Zealand and, in any case in which entitlement to a benefit payable under those laws by a Contracting Party depends, in whole or in part, on citizenship of that Contracting Party, a person who is a citizen of the other Contracting Party shall, for the purposes of a claim for that benefit, deemed to be a citizen of the first-mentioned Contracting Party. |

PART II - RESIDENCE |

Article 5 Entitlement to benefits during residence or presence in a country |

| A person shall not be entitled, by virtue of this Agreement, to the benefits payable by a Contracting Party unless that person: (a) is residing permanently in the territory of that Contracting Party; or (b) has been in that territory for a period of 6 months (without regard to any earlier periods spent in that territory), and otherwise meets the requirements of the social security laws of that Contracting Party in relation to those benefits. |

Article 6 Recognition by one country of residence in the other country |

| 1. Where a person is residing in the territory of one of the Contracting Parties and is a claimant for a benefit payable by that Contracting Party, each period of residence accumulated by that claimant or, as appropriate, by a related person in the territory of the other Contracting Party shall be deemed, for the purposes of the claim for that benefit, to be a period of residence by that claimant or related person in the territory of the first-mentioned Contracting Party. 2. In paragraph 1: (a) "related person" means: (i) the spouse of the claimant; (ii) the last deceased spouse of the claimant; (iii) a child in respect of whom the benefit referred to in paragraph 1 is claimed; or (iv) the last surviving parent, or the deceased parent formerly responsible for the care and control, of the claimant, as the circumstances require; and (b) "benefit" does not include unemployment benefit. 3. For the purposes of the social security laws of Australia relating to family allowance, a period of residence accumulated in New Zealand by a person, and by a child in respect of whom that benefit is claimed by that person, shall be deemed to be a period in which the person and the child had been in Australia. |

Article 7 Country of residence |

| 1. Subject to paragraph 2, the question whether a person is or, at any past time, was residing in the territory of one of the Contracting Parties for the purposes of this Agreement shall be determined by reference to the domestic laws of that Contracting Party. 2. Where, for a period, a person is a resident of both Australia and New Zealand, that period shall be counted: (a) in relation to a claim for an Australian benefit, only as a period of residence in Australia; and (b) in relation to a claim for a New Zealand benefit, only as a period of residence in New Zealand. |

PART III - PROVISIONS RELATING TO BENEFITS |

Article 8 Commencement of benefits |

| Where a person: (a) moves permanently from the territory of one Contracting Party to the territory of the other Contracting Party and arrives in the last-mentioned territory not more than 12 weeks after his or her departure from the first-mentioned territory; and (b) immediately prior to his or her departure, was paid a benefit by the first-mentioned Contracting Party, any benefit that is payable, whether by virtue of this Agreement or otherwise, to that person by that other Contracting Party shall be paid with effect from a date conforming with the pattern of payments for the benefit payable to the person, being a date not later than the date succeeding that on which the first-mentioned benefit ceased to be paid. |

Article 9 Payment of supplementary and additional amounts |

| Where a benefit is payable by a Contracting Party by virtue of this Agreement to or in respect of a person, there shall also be payable any supplement or additional amount that is payable, in addition to that benefit, to or in respect of a person who qualifies for that supplement or additional amount under the social security laws of that Contracting Party. |

Article 10 Entitlement to payment by New Zealand of national superannuation |

| 1. A person shall be entitled by virtue of this Agreement to the payment by New Zealand of national superannuation only if: (a) that person is of an age at which an age pension may be payable to the person; and (b) the income and assets of the person are such as would entitle the person to the payment of an age pension, under the social security laws of Australia. 2. The rate of national superannuation payable by New Zealand by virtue of this Agreement to a person shall be subject to deduction of the amount of any Australian benefit payable to that person, in the same manner as the rate of national superannuation may be reduced under the social security laws of New Zealand by the amount of any overseas benefit, pension or periodical allowance, or part thereof, that is payable to a person entitled to receive a benefit under those laws. |

Article 11 New Zealand widows', domestic purposes and orphans' benefits |

| Where a widow's benefit, a domestic purposes benefit or an orphan's benefit would be payable by New Zealand but for the fact that a child to whom that benefit would relate was born in Australia, that child shall, for the purposes of a claim for that benefit, be deemed to have been born in New Zealand. |

Article 12 Restriction on dual entitlement to certain benefits |

| Where a benefit specified in one of the columns set out in the following table has been paid by the Contracting Party named at the head of that column to or in respect of a person who is residing in the territory of that Contracting Party, that benefit shall cease to be payable if the other Contracting Party pays, to or in respect of that person while he or she is in the territory of the other Contracting Party, a benefit specified in the other column of that table. |

Australian benefit: | New Zealand benefit: |

|---|---|

| Family Allowance | Family Benefit |

| Double Orphan's Pension | Orphan's Benefit |

Article 13 Unemployment benefit |

| 1. This Article applies to any person who is a citizen of one of the Contracting Parties and who is in the territory of the other Contracting Party. 2. Subject to paragraph 4, a person to whom this Article applies shall be entitled to the payment of unemployment benefit by a Contracting Party only if the person: (a) has been continuously present in the territory of that Contracting Party for not less than 6 months since the date of his or her most recent arrival in that territory; (b) is residing in that territory on the date on which the person lodges a claim for that benefit and resides or has resided there throughout the period in respect of which the claim is lodged; (c) satisfies the competent authority of that Contracting Party, by reference to the person's circumstances, or his or her work history in that territory, that the person has permanently settled in that territory; and (d) meets those criteria which are specified for that benefit by the social security laws of that Contracting Party in regard to age, unemployment, capability and willingness to undertake suitable work, efforts to obtain such work and non-receipt of other benefits. 3. For the purposes of sub-paragraph 2(c): (a) a person shall be deemed to satisfy the requirements in relation to work history in the territory of a Contracting Party if, since the date referred to in sub-paragraph 2(a), the person has undertaken: (i) in relation to Australia, paid work for 8 weeks of at least 30 hours per week; or (ii) in relation to New Zealand, 8 weeks full employment; (b) consideration of a person's circumstances shall include consideration of: (i) the person's family arrangements; (ii) the housing or accommodation arrangements of the person and, if applicable, of the spouse and children of the person, whether in the territory of the Contracting Party concerned, of the other Contracting Party or elsewhere, including actions such as the purchase or lease of a home in the first-mentioned territory and the disposal of a former home in the other territory or elsewhere; and (iii) the arrangements made by the person in regard to any bank or comparable accounts, the transfer, disposal or location of any property, and taxation clearances. 4. Where a person to whom this Article applies has been resident in the territory of a Contracting Party for the period of 12 months immediately preceding the date on which the person lodges a claim for unemployment benefit in that territory, the person shall be required to meet, in relation to that claim, only the criteria specified for that benefit by the social security laws of that Contracting Party. 5. For the purposes of paragraph 4, a period of residence in the territory of a Contracting Party in relation to a person shall include any period or periods of temporary absence by that person from that territory that do not exceed in the aggregate 2 calendar months, and that do not break the continuity of that period of residence. |

Article 14 Supporting parents' benefit and domestic purposes benefit |

| 1. This Article applies to any person who is a citizen of one of the Contracting Parties and who is in the territory of the other Contracting Party. 2. Subject to paragraph 3, a person to whom this Article applies shall not be granted a supporting parents' benefit or a domestic purposes benefit by a Contracting Party unless, in addition to meeting the requirements for that benefit of the social security laws of that Contracting Party, the person has been continuously present in the territory of that Contracting Party for not less than 6 months since the date of his or her most recent arrival in that territory. 3. Where a person to whom this Article applies has been resident in the territory of a Contracting Party for the period of 12 months immediately preceding the date on which the person lodges a claim, in Australia, for supporting parents' benefit or, in New Zealand, for domestic purposes benefit, the person shall be required to meet, in relation to that claim, only the criteria specified for that benefit by the social security laws of that Contracting Party. 4. For the purposes of paragraph 3, a period of residence in the territory of a Contracting Party in relation to a person: (a) shall include any period or periods of temporary absence by that person from that territory that do not exceed in the aggregate 2 calendar months, and that do not break the continuity of that period of residence; and (b) shall not include any period deemed by Article 6 to be a period of residence by the person in that territory. |

Article 15 Wife's pension and carer's pension |

| A person who receives from Australia a wife's pension or a carer's pension by virtue of the fact that the spouse of that person receives, by virtue of this Agreement, an Australian benefit shall, for the purposes of this Agreement, be deemed to receive that pension by virtue of this Agreement. |

PART IV - MISCELLANEOUS PROVISIONS |

Article 16 Lodgement of claims |

| 1. Subject to paragraph 3, a claim for a benefit, whether payable by virtue of this Agreement or otherwise, may be lodged in the territory of either of the Contracting Parties, in accordance with administrative arrangements made pursuant to Article 20, at any time after the Agreement enters into force. 2. Where a claim for a benefit payable by one of the Contracting Parties is lodged in the territory of the other Contracting Party in accordance with paragraph 1, the date on which the claim is lodged shall be the date of lodgement of the claim for all purposes relating to the claim. 3. Paragraph 1 applies, in relation to Australia, only to those Australian benefits described as sickness benefit, double orphan's pension and family allowance. |

Article 17 Portability of benefits for temporary absences |

| Where a benefit is payable by one of the Contracting Parties by virtue of this Agreement, that benefit shall be payable, up to a period of 26 weeks, while the beneficiary is in the territory of the other Contracting Party or outside the territory of both, subject to the provisions of this Agreement and of the social security laws of the first-mentioned Contracting Party other than, in relation to Australia, those provisions precluding the payment of benefits outside Australia. |

Article 18 Exclusion of New Zealand benefits from Australian income test |

| Where a benefit is paid by Australia to a person who is in New Zealand and a benefit is also paid by New Zealand to that person, the amount of the benefit paid by New Zealand shall not be included in the income of that person for the purposes of the social security laws of Australia. |

Article 19 Recovery of overpayments |

| 1. Where: (a) an amount paid by one of the Contracting Parties to a person in respect of a benefit exceeds the amount, if any, that is properly payable, whether by virtue of this Agreement or otherwise, in respect of that benefit; and (b) a benefit is payable by the other Contracting Party to that person, whether by virtue of this Agreement or otherwise, the competent authority of that other Contracting Party shall, if requested by the other competent authority to do so, and in accordance with this Article, deduct the amount equivalent to the excess payment referred to in sub-paragraph (a) from amounts due in respect of the last-mentioned benefit. 2. The amount of an excess payment referred to in paragraph 1 shall be the amount determined by the competent authority of the Contracting Party by whom the excess payment was made. 3. The rate of deductions made in accordance with paragraph 1 from amounts due in respect of a benefit, and any incidental or related matters, shall be determined by the competent authority of the Contracting Party by whom that benefit is payable, in accordance with the social security laws of that Contracting Party, including in particular those provisions which relate to deduction from, in the case of Australia, family allowance and, in the case of New Zealand, family benefit. 4. Where, in a case such as that described in sub-paragraph 1(a), the person to whom the excess amount was paid by one of the Contracting Parties is in the territory of the other Contracting Party and is not in receipt of a benefit from that other Contracting Party, the competent authority of that other Contracting Party shall, if requested by the other competent authority to do so, endeavour to arrange with the person for the repayment to the first-mentioned Contracting Party of that excess amount. 5. Amounts deducted by one of the Contracting Parties in accordance with paragraph 1, and any amounts received by that Contracting Party pursuant to arrangements referred to in paragraph 4, shall be remitted to the other Contracting Party as agreed between the competent authorities or in administrative arrangements made pursuant to Article 20. 6. In this Article, "benefit" is not limited to those benefits specified in Article 2. |

Article 20 Administrative arrangements |

| 1. The competent authorities of the Contracting Parties shall make whatever administrative arrangements are necessary from time to time in order to implement this Agreement, and to enable benefits payable by one of the Contracting Parties, whether by virtue of this Agreement or otherwise, to persons who are residing in or in the territory of the other Contracting Party to be paid to those persons on behalf of the first-mentioned Contracting Party by that other Contracting Party. 2. Where arrangements of the kind referred to in paragraph 1 are required to be made on a mutual basis, the competent authorities shall co-operate, both in regard to matters affecting the operation of both social security systems and of each of them. 3. A benefit payable by one of the Contracting Parties by virtue of this Agreement shall be paid by that Contracting Party without deduction for administrative fees and charges. |

Article 21 Exchange of information |

| 1. The competent authorities of the Contracting Parties shall, without limitation by Article 3, exchange such information as is necessary for the operation of this Agreement or of the social security laws of the Contracting Parties concerning all matters arising under this Agreement or under those laws other than those matters referred to in the social security laws of New Zealand as "Contributions Towards Cost of Domestic Purposes Benefits for Solo Parents" and "Medical and Hospital Benefits and other Related Benefits". 2. Any information received by the competent authority of a Contracting Party pursuant to sub-paragraph 1 shall be disclosed only to persons or authorities (including courts and administrative bodies) concerned with matters, including the determination of appeals, arising under the provisions of this Agreement or the social security laws of the Contracting Parties and shall be used for other purposes or disclosed to other persons only with the prior consent of the competent authority who provided the information. 3. In no case shall the provisions of paragraph 1 and 2 be construed so as to impose on the competent authority of a Contracting Party the obligation: (a) to carry out administrative measures at variance with the laws or the administrative practice of that or the other Contracting Party; or (b) to supply particulars which are not obtainable under the laws or in the normal course of the administration of that or of the other Contracting Party. 4. Unless there are reasonable grounds for believing the contrary, any information received by a competent authority from the other competent authority shall be accepted as valid or true, as the case requires. 5. A Contracting Party shall not raise any charges against the other Contracting Party for services of an administrative nature rendered by that first-mentioned Contracting Party to the other in accordance with this Agreement or the administrative arrangements made pursuant to Article 20, but that other Contracting Party shall meet any costs or expenses which are reasonably incurred for those services and are payable to another person or organisation. |

Article 22 Appeals |

| 1. Any person who is affected by a determination, direction, decision or approval made or given by the competent authority or an institution of a Contracting Party, in relation to a matter arising by virtue of this Agreement, shall have the same rights to the review, by administrative and judicial bodies of that Contracting Party, of that determination, direction, decision or approval as are provided under the domestic laws of that Contracting Party. 2. Documents relating to appeals that may be made to administrative bodies established by, or administratively for the purposes of, the social security laws of Australia or New Zealand may be lodged in the territory of the other Contracting Party, respectively, in accordance with administrative arrangements made pursuant to Article 20 and any documents duly lodged in that manner shall be regarded as duly lodged for the purposes of those laws. 3. The date on which the document is duly lodged in the territory of one of the Contracting Parties in accordance with paragraph 2 shall determine whether that document is lodged within any time limit specified by the laws or administrative practices of the other Contracting Party which govern the appeal concerned. |

Article 23 Review of Agreement |

| The Contracting Parties may agree at any time to review any of the provisions of this Agreement and, in any case, shall, within the period of 3 years commencing on the date of signature of this Agreement, review the present limitation on continuation of payment by a Contracting Party of benefits to beneficiaries who move outside the territory of that Contracting Party. |

PART V - FINAL PROVISIONS |

Article 24 Entry into force |

| This Agreement shall enter into force on the date on which the Contracting Parties sign the agreement and thereupon this Agreement shall have effect on and from the date specified. |

Article 25 Termination |

| 1. Subject to paragraph 2, this Agreement shall remain in force until the expiration of 12 months from the date on which either Contracting Party receives from the other written notice through the diplomatic channel of the intention of the other Contracting Party to terminate this Agreement. 2. In the event that this Agreement is terminated in accordance with paragraph 1, the Agreement shall continue to have effect in relation to all persons who: (a) at the date of termination, are in receipt of benefits; or (b) prior to the expiry of the period referred to in that paragraph, have lodged claims for, and would be entitled to receive, benefits, by virtue of this Agreement. |

| IN WITNESS WHEREOF the undersigned, duly authorised thereto, have signed this Agreement. Done in duplicate at Wellington this eighth day of July 2004. |

FOR THE GOVERNMENT OF AUSTRALIA: | FOR THE GOVERNMENT OF NEW ZEALAND: |

|---|---|

JULIA E. GILLARD | HELEN E. CLARK |

|

| THE GOVERNMENT OF AUSTRALIA, AND THE GOVERNMENT OF NEW ZEALAND DESIROUS of providing immediately necessary medical treatment for residents of the territory of one Party temporarily in the territory of the other Party, HAVE AGREED as follows: |

Article 1 Interpretation |

| For the purpose of this Agreement: (1) "medical treatment" means: (a) in relation to Australia, pharmaceutical benefits provided to a general patient as defined under the National Health Act 1953, and any public hospital service provided to a public patient within the public health system provided under the Health Insurance Act 1973, and any determination or authorisation made under the Health Insurance Act 1973; and (b) in relation to the territory of New Zealand (excluding Niue) pharmaceutical benefits (excluding any additional pharmaceutical benefit provided to a holder of a community services card issued pursuant to the Health Entitlement Cards Regulations 1993 or any replacement regulations), and hospital services and maternity services provided in accordance with the relevant funding agreement (as defined in section 21(1) of the Health and Disability Services Act 1993); (c) in relation to Niue, pharmaceutical benefits and hospital services provided under the Niue Act 1966. (2) "resident" means: (a) in relation to the territory of Australia, a person who is an Australian resident for the purposes of the Health Insurance Act 1973; and (b) in relation to the territory of New Zealand, a person who is ordinarily resident in the territory of New Zealand: (3) "evidence of residence" means: (a) in relation to an Australian resident temporarily in the territory of New Zealand, a current Australian passport or any other current passport endorsed to the effect that the holder is entitled to reside in Australia indefinitely; and (b) in relation to a New Zealand resident temporarily in the territory of Australia: (i) a current New Zealand passport; or (ii) any other current passport or current certificate of identity endorsed to the effect that the holder is entitled to be in New Zealand indefinitely: or (iii) a current refugee travel document granted by the Government of New Zealand. (4) "territory" means: (a) in relation to Australia, the territory of Australia, excluding all external territories other than the Territories of Cocos (Keeling) Island and Christmas Island; and (b) in relation to New Zealand, the territory of New Zealand including Tokelau together with the associated self-governing State of Niue. (5) "temporarily in the territory" means: (a) in relation to the territory of Australia, lawfully present but not resident in that territory; and (b) in relation to the territory of New Zealand, lawfully present but not ordinarily resident in that territory. (6) "public patient" means, in relation to a public hospital service in Australia, a person who is eligible for medical treatment as a public patient under the Health Insurance Act 1973.(7) "competent authorities" means: (a) in relation to Australia, the Department of Health, or such other department which may in the future carry out the relevant functions of the Department of Health. (b) in relation to New Zealand, the Ministry of Health, or such other department which may in the future carry out the relevant functions of the Ministry of Health. |

Article 2 Persons to whom Agreement applies |

| (1) This Agreement applies to a resident of the territory of one Party who is able to provide in relation to that resident evidence of residence in that territory and who is temporarily in the territory of the other Party. (2) This agreement does not apply to a resident of the territory of one Party who enters the territory of the other Party for the specific purpose of seeking medical treatment. (3) Notwithstanding paragraph (2) of this Article, where a resident of the territory of one Party is a member of the crew or passenger on any non-commercial vessel, or is a member of the crew or a passenger on an aircraft travelling to, leaving from, or diverted to the territory of the other Party and the need for medical treatment arises during the voyage or flight, that resident shall be entitled to that medical treatment. |

Article 3 Medical treatment |

| A resident of the territory of one Party (being a person to whom this Agreement applies according to Article 2) who, in the opinion of the provider of medical treatment, needs immediately necessary medical treatment while in the territory of the other Party, shall be provided with such medical treatment as is clinically necessary for the diagnosis, alleviation or care of the condition requiring attention, on terms no less favourable than would apply to a person who is a resident of the latter territory. |

Article 4 Financial arrangements |

| (1) Neither Party shall be liable to make any payment to the other Party in respect of medical treatment provided under Article 3. (2) Any amount payable for medical treatment provided under Article 3, pursuant to this Agreement, shall be borne by the person in respect of whom the medical treatment is provided. |

Article 5 Communication between competent authorities |

| (1) The competent authorities shall send to each other, as soon as possible, details of any changes in legislation, determinations, authorisations or funding agreements in force in their respective territories which may significantly affect the nature and scope of services provided under this Agreement. (2) Matters relating to the interpretation or application of this Agreement shall be resolved by consultation between the competent authorities. |

Article 6 Application of agreement |

| (1) At any time, the Parties may agree to amend this Agreement in writing. (2) References in this Agreement to any legislation, determination, authorisation, or funding agreement also include any legislation, determination, authorisation, or funding agreement which replaces, amends, supplements, or consolidates the legislation, determination, authorisation, or funding agreement referred to. (3) For the purposes of this Agreement, unless the context otherwise requires, other words and expressions used in the Agreement have the meanings assigned to them respectively under the legislation or funding agreement referred to in Article 1 paragraph (1). |

Article 7 Term of Agreement |

| (1) This Agreement shall enter into force on the date specified below upon signatures from each Party. (2) This Agreement shall remain in force until the expiration of 12 months from the date on which either Party receives from the other written notice through diplomatic channels of its intention to terminate this Agreement. (3) In the event that this Agreement is terminated in accordance with paragraph (2), the Agreement shall continue to have effect in relation to medical treatment which was being provided immediately prior to or at the expiry of the period referred to in that paragraph. |

| IN WITNESS WHEREOF the undersigned, duly authorised thereto, have signed this Agreement. DONE in duplicate at Wellington this eighth day of July 2004. |

FOR THE GOVERNMENT OF AUSTRALIA: | FOR THE GOVERNMENT OF NEW ZEALAND: |

|---|---|

JULIA E. GILLARD | HELEN E. CLARK |

|

|

| AUSTRALIA AND NEW ZEALAND (hereinafter in this Agreement called the "Member States"), CONSCIOUS of their longstanding and close historic, political, economic and geographic relationship; RECOGNISING that the further development of this relationship will be served by the expansion of trade and the strengthening and fostering of links and co-operation in such fields as investment, marketing, movement of people, tourism and transport; RECOGNISING also that an appropriately structured closer economic relationship will bring economic and social benefits and improve the living standards of their people; MINDFUL that a substantive and mutually beneficial expansion of trade will be central to such a relationship; RECOGNISING that a clearly established and secure trading framework will best give their industries the confidence to take investment and planning decisions having regard to the wider trans-Tasman market; BEARING IN MIND their commitment to an outward looking approach to trade; BELIEVING that a closer economic relationship will lead to a more effective use of resources and an increased capacity to contribute to the development of the region through closer economic and trading links with other countries, particularly those of the South Pacific and South East Asia; HAVING REGARD to the development of trade which has already taken place; and CONSCIOUS of their rights and obligations under multilateral and bilateral trade agreements and under bilateral arrangements with developing countries of the South Pacific region; HAVE AGREED as follows: |

Article 1 Objectives |

| The objectives of the Member States in concluding this Agreement are: (a) to strengthen the broader relationship between Australia and New Zealand; (b) to develop closer economic relations between the Member States through a mutually beneficial expansion of free trade between New Zealand and Australia; (c) to eliminate barriers to trade between Australia and New Zealand in a gradual and progressive manner under an agreed timetable and with a minimum of disruption; and (d) to develop trade between New Zealand and Australia under conditions of fair competition. |

Article 2 Free Trade Area |

| 1. The Free Trade Area (hereinafter in this Agreement called "the Area") to which this Agreement applies consists of Australia and New Zealand. 2. In this context New Zealand means the territory of New Zealand but does not include the Cook Islands, Niue and Tokelau unless this Agreement is applied to them under Article 23 and Australia means those parts of Australia to which this Agreement applies under Article 23. 3. "Goods traded in the Area" or similar expressions used in this Agreement shall mean goods exported from the territory of one Member State and imported into the territory of the other Member State. |

Article 3 Rules of origin |

| 1. Goods exported from the territory of a Member State directly into the territory of the other Member State or which, if not exported directly, were at the time of their export from the territory of a Member State destined for the territory of the other Member State and were subsequently imported into the territory of that other Member State, shall be treated as goods originating in the territory of the first Member State if those goods are: (a) wholly the unmanufactured raw products of the territory of that Member State; (b) wholly manufactured in the territory of that Member State from one or more of the following: (i) unmanufactured raw products; (ii) materials wholly manufactured in the territory of one or both Member States; (iii) materials imported from outside the Area that the other Member State has determined for the purposes of this Agreement to be manufactured raw materials; or (c) partly manufactured in the territory of that Member State, subject to the following conditions: (i) the process last performed in the manufacture of the goods was performed in the territory of that Member State; and (ii) the expenditure on one or more of the items set out below is not less than one-half of the factory or works cost of such goods in their finished state: A. material that originates in the territory of one or both Member States; B. labour and factory overheads incurred in the territory of one or both Member States; C. inner containers that originate in the territory of one or both Member States. 2. The factory or works cost referred to in paragraph 1(c)(ii) of this Article shall be the sum of costs of materials (excluding customs, excise or other duties), labour, factory overheads, and inner containers. 3. Where a Member State considers that in relation to particular goods partly manufactured in its territory the application of paragraph 1(c)(ii) of this Article is inappropriate, then that Member State may request in writing consultations with the other Member State to determine a suitable proportion of the factory or works cost different from that provided in paragraph 1(c)(ii) of this Article. The Member States shall consult promptly and may mutually determine for such goods a proportion of the factory or works cost different to that provided in paragraph 1(c)(ii) of this Article. |

Article 4 Tariffs |

| 1. Goods originating in the territory of a Member State which in the territory of the other Member State were free of tariffs on the day immediately before the day on which this Agreement enters into force or which subsequently become free of tariffs shall remain free of tariffs. 2. No tariff shall be increased on any goods originating in the territory of the other Member State. 3. Tariffs on all goods originating in the territory of the other Member State shall be reduced in accordance with paragraph 4 of this Article and eliminated within five years from the day on which this Agreement enters into force. 4. If, on the day immediately before the day on which this Agreement enters into force, goods originating in the territory of the other Member State are: (a) subject to tariffs not exceeding 5 per cent ad valorem or tariffs of equivalent effect, they shall be free of tariffs from the day on which this Agreement enters into force; (b) subject to tariffs of more than 5 per cent but not exceeding 30 per cent ad valorem or tariffs of equivalent effect, tariffs on those goods shall be reduced on the day on which this Agreement enters into force by 5 percentage points and rounded down to the nearest whole number where fractional rates are involved. Thereafter, tariffs shall be reduced by 5 percentage points per annum; or (c) subject to tariffs of more than 30 per cent ad valorem or tariffs of equivalent effect, tariffs on those goods shall be reduced on the day on which this Agreement enters into force and annually thereafter by an amount calculated by dividing by six the tariff applying to the goods on the day immediately before the day on which this Agreement enters into force and rounding to the nearest whole number, with an additional deduction being made, where necessary, at the time of the first reduction so that tariffs are eliminated over a five-year period. A fraction of exactly one-half per cent shall be rounded to the higher whole number. 5. For the purposes of paragraph 4 of this Article, the term "tariffs of equivalent effect" shall mean tariffs which are not expressed solely in ad valorem terms. Where goods are subject to such tariffs, for the purposes of determining which of the sub-paragraphs (a), (b) or (c) of paragraph 4 of this Article shall apply to those goods, those tariffs shall be deemed to be equivalent to the ad valorem rates obtained by expressing the tariff as a percentage of the assessed unit value of the goods imported from the other Member State in the year ending 30 June 1982. If in that year there have been no imports of those goods from the other Member State or, if in the opinion of the Member State which is making adjustments to its tariffs the imports of those goods were not representative of the usual and ordinary course of trade between the Member States in those goods, the Member State making the adjustment shall take account of the imports from the other Member State in the previous year. If this is insufficient to represent the usual and ordinary course of trade between the Member States in those goods then global imports shall be used to determine the adjustment on the same basis. 6. Where in this Article reference is made to goods being subject to a tariff on the day immediately before the day on which this Agreement enters into force, it shall in relation to the Australian Tariff mean the simplified Tariff that would have been effective from 1 January 2004 in the absence of this Agreement. 7. Where in this Agreement reference is made to: (a) a Tariff Heading, it shall in relation to the Australian Tariff mean an Item; and (b) a Tariff Item, it shall in relation to the Australian Tariff mean a Sub-Item, Paragraph or Sub-Paragraph as the case may be. 8. A Member State may reduce or eliminate tariffs more rapidly than is provided in paragraph 4 of this Article. 9. Tariffs on goods originating in New Zealand and imported into Australia shall in no case be higher than the lowest tariff applicable to the same goods if imported from any third country other than Papua New Guinea or countries eligible for any concessional tariff treatment accorded to less developed countries. 10. Tariffs on goods originating in Australia and imported into New Zealand shall in no case be higher than the lowest tariff applicable to the same goods if imported from any third country other than the Cook Islands, Niue, Tokelau and Western Samoa or countries eligible for any concessional tariff treatment accorded to less developed countries. 11. In any consideration of assistance and protection for industry a Member State: (a) shall set the tariff at the lowest tariff which: (i) is consistent with the need to protect its own producers or manufacturers of like or directly competitive goods; and (ii) will permit reasonable competition in its market between goods produced or manufactured in its own territory and like goods or directly competitive goods imported from the territory of the other Member State; (b) in forwarding a reference to an industry advisory body, shall request that body to take account of sub-paragraph (a) of this paragraph in framing its recommendations; (c) wherever practicable, shall not reduce the margins of preference accorded the other Member State; and (d) shall give sympathetic consideration to maintaining a margin of preference of at least 5 per cent for the other Member State when reducing normal or general tariffs either substantively or by by-law or concession on goods of significant trade interest to that Member State. 12. For the purpose of paragraph 11 of this Article "Margin of preference" means: (i) in the case of Australia, the difference between the General tariff imposed on goods and the tariff imposed on the same goods originating in New Zealand; and (ii) in the case of New Zealand, the difference between the Normal tariff imposed on goods and the tariff imposed on the same goods originating in Australia. 13. In this Article "Tariff" shall include any customs or import duty and charge of any kind imposed in connection with the importation of goods, including any form of primage duty, surtax or surcharge on imports, with the exception of: (a) fees or charges connected with importation which approximate the cost of services rendered and do not represent an indirect form of protection or a taxation for fiscal purposes; (b) duties, taxes or other charges on goods, ingredients and components, or those portions of such duties, taxes or other charges, which are levied at rates not higher than those duties, taxes or other charges applied to like goods, ingredients and components produced or manufactured in the country of importation; (c) premiums offered or collected on imported goods in connection with any tendering system in respect of the administration of quantitative import restrictions or tariff quotas; (d) duties applying to imports outside the established quota levels of goods subject to tariff quota, provided that paragraphs 9 and 10 and sub-paragraph 11(c) of this Article shall apply to such duties; (e) sales or like taxes or those portions of such taxes which do not exceed the taxes applied to like goods produced or manufactured in the country of importation; (f) charges imposed pursuant to Articles 14, 15, 16 or 17 of this Agreement; and (g) those by-law or concessionary rates which are mutually determined by the Member States. |

Article 5 Quantitative import restrictions and tariff quotas |

| 1. Goods originating in the territory of a Member State which in the territory of the other Member State were free of quantitative import restrictions or tariff quotas on the day immediately before the day on which this Agreement enters into force or which subsequently become free of such measures shall remain free. 2. No quantitative import restrictions or tariff quotas shall be intensified on goods originating in the territory of the other Member State. 3. Quantitative import restrictions and tariff quotas on all goods originating in the territory of the other Member State shall be progressively liberalised and eliminated. 4. Each Member State shall establish a base level of access for each grouping of goods subject to quantitative import restrictions or tariff quotas. This shall be the average annual level of imports of goods in each such grouping from the other Member State in the three year period ending 30 June 2002. 5. In respect of liberalisation to come into effect in 2004 each Member State shall: (a) where the base level of access is less than $NZ400,000 cif, establish an increase in access for goods originating in the territory of the other Member State which shall be the greater of the following two figures on an annual basis: (i) $NZ60,000 cif; or (ii) the difference between $NZ400,000 cif and the base level of access; (b) where the base level of access equals or exceeds $NZ400,000 cif but is less than $NZ 1 million cif, establish an increase in access for goods originating in the territory of the other Member State of 15 per cent per annum in real terms above the base level of access; and (c) where the base level of access equals or exceeds $NZ 1 million cif, establish an increase in access for goods originating in the territory of the other Member State of 10 per cent per annum in real terms above the base level of access. 6. Notwithstanding sub-paragraph (a) of paragraph 5 of this Article, a Member State may limit the increase in access for goods originating in the territory of the other Member State to be established in 2004 to an annual level equal to: (a) in respect of groupings of goods, the greater of: (i) $NZ60,000 cif; or (ii) the difference between 5 per cent of the domestic market or $NZ200,000 cif whichever is the higher and the base level of access; 7. In respect of liberalisation to come into effect in 2005 and each subsequent year, each Member State shall establish an annual increase in access for goods originating in the territory of the other Member State above the level of access available in the previous year of: (a) 15 per cent in real terms in respect of groupings of goods for which the level of access is less than $NZ 1 million cif in that previous year; or (b) 10 per cent in real terms in respect of groupings of goods for which the level of access equals or exceeds $NZ 1 million cif in that previous year. 8. A Member State may establish an initial increase in the level of access for goods originating in the territory of the other Member State for a period longer than one year provided that the increase in the level of access is consistent with paragraphs 5, 6 and 7 of this Article. 9. A Member State may liberalise more rapidly or eliminate earlier than is provided in paragraphs 5, 6 and 7 of this Article quantitative import restrictions or tariff quotas on goods originating in the territory of the other Member State. 10. The increases in access to be established under paragraphs 5, 6 and 7 of this Article shall be achieved through the provision by each Member State of access applicable exclusively to goods originating in the territory of the other Member State (hereinafter in this Agreement called "exclusive access") except as provided in paragraphs 20 and 21 of this Article. 11. Where access is expressed in terms of value, in order to achieve the annual increases in access levels in real terms pursuant to paragraphs 5 and 7 of this Article, each Member State shall adjust access levels to reflect changes in prices in the importing country in the previous year in a manner mutually determined by the Member States. 12. The access provided pursuant to this Article shall relate as far as practicable to the same groupings of goods that are used for the purpose of applying quantitative import restrictions or tariff quotas on a global basis. Where a Member State applies quantitative import restrictions or tariff quotas on a global basis measured in terms of quantity rather than value, an equivalent figure in terms of quantity as mutually determined by the Member States shall be substituted for the levels of access specified in paragraphs 5, 6 and 7 of this Article. 13. Where as part of a system of quantitative import restrictions or tariff quotas a Member State accords licence on demand treatment, replacement licensing treatment or similar liberal treatment to goods originating in the territory of the other Member State and such treatment does not result in constraints on imports from the other Member State: (a) it may maintain such treatment for general monitoring purposes; and (b) paragraphs 4 to 12 of this Article shall not apply to such goods. 14. Quantitative import restrictions and tariff quotas on all goods originating in the territory of the other Member State shall be eliminated by 30 June 2005. 15. Levels of access into New Zealand for goods originating in Australia shall be referred to in New Zealand currency on a cif basis as set out in this Article. Levels of access into Australia for goods originating in New Zealand shall be expressed in Australian currency on an fob basis and in applying this Article to such goods the following shall apply: (a) for $NZ60,000 cif substitute $A41,000 fob; (b) for $NZ200,000 cif substitute $A136,000 fob; (c) for $NZ400,000 cif substitute $A272,000 fob; and (d) for $NZ 1 million cif substitute $A680,000 fob. 16. Where, in the opinion of a Member State, the application of this Article does not provide a level of exclusive access for any goods or an allocation for any importer of those goods which is commercially viable, that Member State may give written notice to the other Member State. The Member States shall consult to determine within 30 days of such notice whether the level of exclusive access or allocation in respect of those goods is commercially viable and, if not, the increase in the level of exclusive access or allocation necessary to render the importation of those goods commercially viable. 17. A Member State shall, at any time during which quantitative import restrictions or tariff quotas are being liberalised pursuant to this Article, more rapidly liberalise or eliminate such measures on particular goods where: (a) such measures are no longer effective or necessary; or (b) for a period of two consecutive years those goods are free of tariffs within the meaning of Article 4 of this Agreement and: (i) the total successful tender premium bid for exclusive access represents less than 5 per cent of the value of the exclusive access allocated by tender for the grouping relevant to those goods; or (ii) less than 75 per cent of the exclusive access allocated for the grouping relevant to those goods has been utilised. 18. Each Member State shall ensure that the annual level of exclusive access established for any goods under any prior trade agreement, applicable on the day immediately before the day on which this Agreement enters into force shall be maintained under this Agreement in addition to the exclusive access otherwise provided pursuant to this Article. 19. In providing access on a global basis, each Member State shall ensure that such access is available for goods originating in the territory of the other Member State. 20. In calculating the exclusive access necessary to achieve the annual increases in access in real terms required under this Article for goods originating in the territory of the other Member State, a Member State shall take into account any increases or decreases in the level of global access available. 21. A Member State may at any time convert exclusive access to global access provided that it gives at the earliest possible date prior written notice to the other Member State of the proposed conversion, and provided also that the conversion is effected in a manner which to the maximum extent possible is predictable, not too abrupt in its impact and consistent with the progressive liberalisation of quantitative import restrictions and tariff quotas pursuant to this Article. Where a Member State receives notice under this paragraph it may request consultations with the other Member State. The Member States shall thereupon promptly enter into consultations. 22. In allocating exclusive access in respect of goods originating in the territory of the other Member State, a Member State shall have regard to: (a) the need to provide genuine access opportunity for those goods; (b) import performance in respect of those goods; and (c) the need to publish the names of licence or quota holders. |

Article 6 Modified application of this Agreement |

| Because of special circumstances a number of the provisions of this Agreement shall be applied to certain goods in a modified manner to the extent specified in Annexes of this Agreement which may be added on the agreement of the Member States. |

Article 7 Revenue duties |

| 1. A Member State may levy for revenue purposes duties on goods, ingredients or components contained in those goods, originating in and imported from the territory of the other Member State, at rates not higher than those that apply to like goods, ingredients or components produced or manufactured in the territory of the first Member State. 2. A Member State shall not levy on goods, ingredients or components contained in those goods, originating in and imported from the territory of the other Member State, any internal taxes or other internal charges of any kind in excess of those applied, directly or indirectly, to like domestic goods, ingredients or components. |

Article 8 Quantitative export restrictions |

| 1. The Member States shall take steps to reduce and eliminate quantitative export restrictions on trade in the Area in a manner to be mutually determined. 2. A Member State shall not impose new quantitative export restrictions or intensify existing quantitative export restrictions on the export of goods to the territory of the other Member State. 3. The provisions of this Article shall not prevent a Member State from taking such measures as may be necessary to prevent evasion, by means of re-export, of quantitative export restrictions which it applies in respect of goods exported to countries outside the Area. |

Article 9 Export subsidies and incentives |

| 1. The Member States shall work towards the elimination of all export subsidies and export incentives on goods traded in the Area. 2. Where a Member State effects a general elimination of or reduction in any export subsidy or export incentive such elimination or reduction shall apply to goods traded in the Area. 3. In respect of goods traded in the Area, neither Member State shall: (a) introduce any export subsidy, export incentive or other assistance measure having similar trade distorting effects to any of the performance-based export incentives listed in Annex A of this Agreement; (b) extend any of the performance-based export incentives listed in Annex A of this Agreement to any industry or sector of industry, or to any class of goods which was ineligible to receive assistance under such incentive on the day immediately before the day on which this Agreement enters into force; or (c) increase the basic rate of assistance available under any of the performance-based export incentives listed in Annex A of this Agreement. 4. In respect of goods traded in the Area the performance-based export incentives listed in Annex A of this Agreement shall be progressively reduced and eliminated in accordance with the following provisions and Annex A of this Agreement: (a) assistance in 2006 shall not exceed 50 per cent of the entitlement to benefit which would otherwise have been available under such export incentives; (b) assistance in 2007 shall not exceed 25 per cent of the entitlement to benefit which would otherwise have been available under such export incentives; and (c) there shall be no entitlement to benefit under such export incentives in 2008 or thereafter. 5. Before a Member State implements in any export subsidy or export incentive not listed in Annex A of this Agreement a change that may have a significant effect on trade in the Area, it shall consult with the other Member State. |

Article 10 Agricultural stabilisation and support |

| 1. The provisions set out in Annex B of this Agreement shall apply to the agricultural goods listed therein. 2. Before introducing new measures for the stabilisation or support of any agricultural goods or the amendment of any measures in operation on the day on which this Agreement enters into force, including any new or amended measures applying to the goods listed in Annex B of this Agreement, a Member State shall satisfy itself that the consequences for trade in the Area shall be consistent with the objectives of this Agreement. 3. If a Member State gives written notice to the other Member State that, in its opinion, the consequences for trade in the Area of measures taken or to be taken by the other Member State for the stabilisation or support of agricultural goods are inconsistent with the objectives of this Agreement, the Member States shall promptly enter into consultations. 4. The Member States shall, as appropriate, co-operate in respect of trade in agricultural goods in third country markets and to this end shall encourage co-operation between Australian and New Zealand marketing authorities. |

Article 11 Government purchasing |