- Jul 2, 2018

- 3,497

The Prime Minister would place her signature on the agreement and would hand a certified copy to her New Zealand counterpart.

"This is truly a momentous occassion, this is the first fully liberalising trade agreement Australia has signed. We couldn't think of any nation better than New Zealand to have this agreement with."

basedcnt

|

|

| AUSTRALIA AND NEW ZEALAND (hereinafter in this Agreement called the "Member States"), CONSCIOUS of their longstanding and close historic, political, economic and geographic relationship; RECOGNISING that the further development of this relationship will be served by the expansion of trade and the strengthening and fostering of links and co-operation in such fields as investment, marketing, movement of people, tourism and transport; RECOGNISING also that an appropriately structured closer economic relationship will bring economic and social benefits and improve the living standards of their people; MINDFUL that a substantive and mutually beneficial expansion of trade will be central to such a relationship; RECOGNISING that a clearly established and secure trading framework will best give their industries the confidence to take investment and planning decisions having regard to the wider trans-Tasman market; BEARING IN MIND their commitment to an outward looking approach to trade; BELIEVING that a closer economic relationship will lead to a more effective use of resources and an increased capacity to contribute to the development of the region through closer economic and trading links with other countries, particularly those of the South Pacific and South East Asia; HAVING REGARD to the development of trade which has already taken place; and CONSCIOUS of their rights and obligations under multilateral and bilateral trade agreements and under bilateral arrangements with developing countries of the South Pacific region; HAVE AGREED as follows: |

Article 1 Objectives |

| The objectives of the Member States in concluding this Agreement are: (a) to strengthen the broader relationship between Australia and New Zealand; (b) to develop closer economic relations between the Member States through a mutually beneficial expansion of free trade between New Zealand and Australia; (c) to eliminate barriers to trade between Australia and New Zealand in a gradual and progressive manner under an agreed timetable and with a minimum of disruption; and (d) to develop trade between New Zealand and Australia under conditions of fair competition. |

Article 2 Free Trade Area |

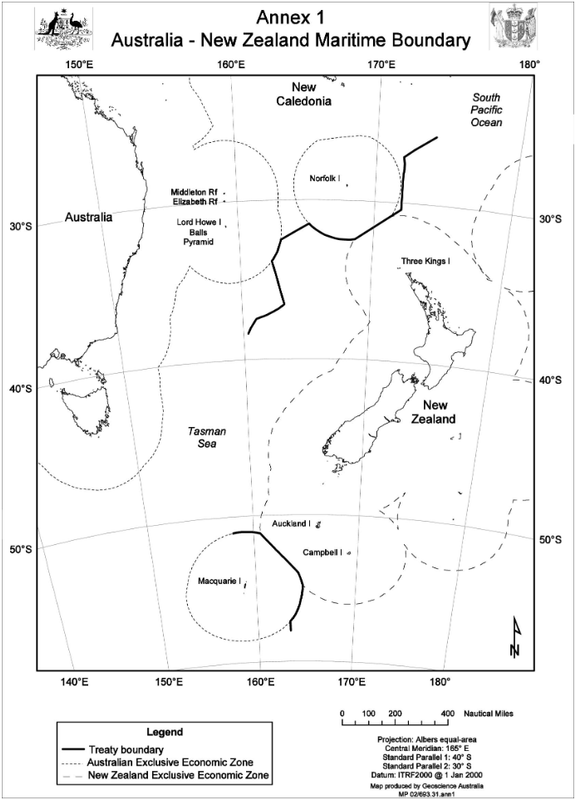

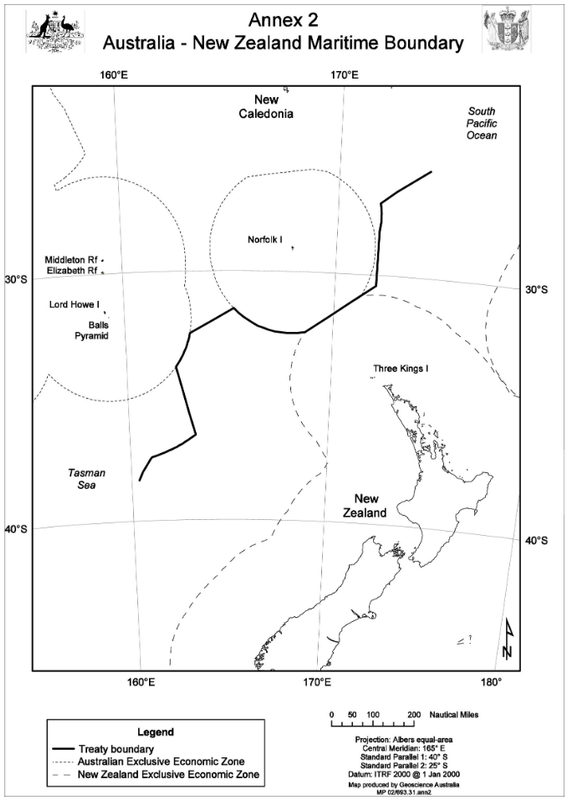

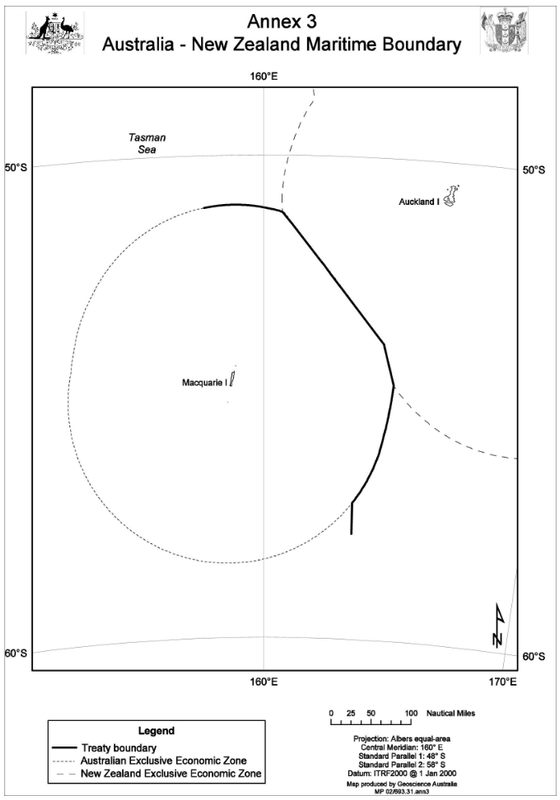

| 1. The Free Trade Area (hereinafter in this Agreement called "the Area") to which this Agreement applies consists of Australia and New Zealand. 2. In this context New Zealand means the territory of New Zealand but does not include the Cook Islands, Niue and Tokelau unless this Agreement is applied to them under Article 23 and Australia means those parts of Australia to which this Agreement applies under Article 23. 3. "Goods traded in the Area" or similar expressions used in this Agreement shall mean goods exported from the territory of one Member State and imported into the territory of the other Member State. |

Article 3 Rules of origin |

| 1. Goods exported from the territory of a Member State directly into the territory of the other Member State or which, if not exported directly, were at the time of their export from the territory of a Member State destined for the territory of the other Member State and were subsequently imported into the territory of that other Member State, shall be treated as goods originating in the territory of the first Member State if those goods are: (a) wholly the unmanufactured raw products of the territory of that Member State; (b) wholly manufactured in the territory of that Member State from one or more of the following: (i) unmanufactured raw products; (ii) materials wholly manufactured in the territory of one or both Member States; (iii) materials imported from outside the Area that the other Member State has determined for the purposes of this Agreement to be manufactured raw materials; or (c) partly manufactured in the territory of that Member State, subject to the following conditions: (i) the process last performed in the manufacture of the goods was performed in the territory of that Member State; and (ii) the expenditure on one or more of the items set out below is not less than one-half of the factory or works cost of such goods in their finished state: A. material that originates in the territory of one or both Member States; B. labour and factory overheads incurred in the territory of one or both Member States; C. inner containers that originate in the territory of one or both Member States. 2. The factory or works cost referred to in paragraph 1(c)(ii) of this Article shall be the sum of costs of materials (excluding customs, excise or other duties), labour, factory overheads, and inner containers. 3. Where a Member State considers that in relation to particular goods partly manufactured in its territory the application of paragraph 1(c)(ii) of this Article is inappropriate, then that Member State may request in writing consultations with the other Member State to determine a suitable proportion of the factory or works cost different from that provided in paragraph 1(c)(ii) of this Article. The Member States shall consult promptly and may mutually determine for such goods a proportion of the factory or works cost different to that provided in paragraph 1(c)(ii) of this Article. |

Article 4 Tariffs |

| 1. Goods originating in the territory of a Member State which in the territory of the other Member State were free of tariffs on the day immediately before the day on which this Agreement enters into force or which subsequently become free of tariffs shall remain free of tariffs. 2. No tariff shall be increased on any goods originating in the territory of the other Member State. 3. Tariffs on all goods originating in the territory of the other Member State shall be reduced in accordance with paragraph 4 of this Article and eliminated within five years from the day on which this Agreement enters into force. 4. If, on the day immediately before the day on which this Agreement enters into force, goods originating in the territory of the other Member State are: (a) subject to tariffs not exceeding 5 per cent ad valorem or tariffs of equivalent effect, they shall be free of tariffs from the day on which this Agreement enters into force; (b) subject to tariffs of more than 5 per cent but not exceeding 30 per cent ad valorem or tariffs of equivalent effect, tariffs on those goods shall be reduced on the day on which this Agreement enters into force by 5 percentage points and rounded down to the nearest whole number where fractional rates are involved. Thereafter, tariffs shall be reduced by 5 percentage points per annum; or (c) subject to tariffs of more than 30 per cent ad valorem or tariffs of equivalent effect, tariffs on those goods shall be reduced on the day on which this Agreement enters into force and annually thereafter by an amount calculated by dividing by six the tariff applying to the goods on the day immediately before the day on which this Agreement enters into force and rounding to the nearest whole number, with an additional deduction being made, where necessary, at the time of the first reduction so that tariffs are eliminated over a five-year period. A fraction of exactly one-half per cent shall be rounded to the higher whole number. 5. For the purposes of paragraph 4 of this Article, the term "tariffs of equivalent effect" shall mean tariffs which are not expressed solely in ad valorem terms. Where goods are subject to such tariffs, for the purposes of determining which of the sub-paragraphs (a), (b) or (c) of paragraph 4 of this Article shall apply to those goods, those tariffs shall be deemed to be equivalent to the ad valorem rates obtained by expressing the tariff as a percentage of the assessed unit value of the goods imported from the other Member State in the year ending 30 June 1982. If in that year there have been no imports of those goods from the other Member State or, if in the opinion of the Member State which is making adjustments to its tariffs the imports of those goods were not representative of the usual and ordinary course of trade between the Member States in those goods, the Member State making the adjustment shall take account of the imports from the other Member State in the previous year. If this is insufficient to represent the usual and ordinary course of trade between the Member States in those goods then global imports shall be used to determine the adjustment on the same basis. 6. Where in this Article reference is made to goods being subject to a tariff on the day immediately before the day on which this Agreement enters into force, it shall in relation to the Australian Tariff mean the simplified Tariff that would have been effective from 1 January 2004 in the absence of this Agreement. 7. Where in this Agreement reference is made to: (a) a Tariff Heading, it shall in relation to the Australian Tariff mean an Item; and (b) a Tariff Item, it shall in relation to the Australian Tariff mean a Sub-Item, Paragraph or Sub-Paragraph as the case may be. 8. A Member State may reduce or eliminate tariffs more rapidly than is provided in paragraph 4 of this Article. 9. Tariffs on goods originating in New Zealand and imported into Australia shall in no case be higher than the lowest tariff applicable to the same goods if imported from any third country other than Papua New Guinea or countries eligible for any concessional tariff treatment accorded to less developed countries. 10. Tariffs on goods originating in Australia and imported into New Zealand shall in no case be higher than the lowest tariff applicable to the same goods if imported from any third country other than the Cook Islands, Niue, Tokelau and Western Samoa or countries eligible for any concessional tariff treatment accorded to less developed countries. 11. In any consideration of assistance and protection for industry a Member State: (a) shall set the tariff at the lowest tariff which: (i) is consistent with the need to protect its own producers or manufacturers of like or directly competitive goods; and (ii) will permit reasonable competition in its market between goods produced or manufactured in its own territory and like goods or directly competitive goods imported from the territory of the other Member State; (b) in forwarding a reference to an industry advisory body, shall request that body to take account of sub-paragraph (a) of this paragraph in framing its recommendations; (c) wherever practicable, shall not reduce the margins of preference accorded the other Member State; and (d) shall give sympathetic consideration to maintaining a margin of preference of at least 5 per cent for the other Member State when reducing normal or general tariffs either substantively or by by-law or concession on goods of significant trade interest to that Member State. 12. For the purpose of paragraph 11 of this Article "Margin of preference" means: (i) in the case of Australia, the difference between the General tariff imposed on goods and the tariff imposed on the same goods originating in New Zealand; and (ii) in the case of New Zealand, the difference between the Normal tariff imposed on goods and the tariff imposed on the same goods originating in Australia. 13. In this Article "Tariff" shall include any customs or import duty and charge of any kind imposed in connection with the importation of goods, including any form of primage duty, surtax or surcharge on imports, with the exception of: (a) fees or charges connected with importation which approximate the cost of services rendered and do not represent an indirect form of protection or a taxation for fiscal purposes; (b) duties, taxes or other charges on goods, ingredients and components, or those portions of such duties, taxes or other charges, which are levied at rates not higher than those duties, taxes or other charges applied to like goods, ingredients and components produced or manufactured in the country of importation; (c) premiums offered or collected on imported goods in connection with any tendering system in respect of the administration of quantitative import restrictions or tariff quotas; (d) duties applying to imports outside the established quota levels of goods subject to tariff quota, provided that paragraphs 9 and 10 and sub-paragraph 11(c) of this Article shall apply to such duties; (e) sales or like taxes or those portions of such taxes which do not exceed the taxes applied to like goods produced or manufactured in the country of importation; (f) charges imposed pursuant to Articles 14, 15, 16 or 17 of this Agreement; and (g) those by-law or concessionary rates which are mutually determined by the Member States. |

Article 5 Quantitative import restrictions and tariff quotas |

| 1. Goods originating in the territory of a Member State which in the territory of the other Member State were free of quantitative import restrictions or tariff quotas on the day immediately before the day on which this Agreement enters into force or which subsequently become free of such measures shall remain free. 2. No quantitative import restrictions or tariff quotas shall be intensified on goods originating in the territory of the other Member State. 3. Quantitative import restrictions and tariff quotas on all goods originating in the territory of the other Member State shall be progressively liberalised and eliminated. 4. Each Member State shall establish a base level of access for each grouping of goods subject to quantitative import restrictions or tariff quotas. This shall be the average annual level of imports of goods in each such grouping from the other Member State in the three year period ending 30 June 2002. 5. In respect of liberalisation to come into effect in 2004 each Member State shall: (a) where the base level of access is less than $NZ400,000 cif, establish an increase in access for goods originating in the territory of the other Member State which shall be the greater of the following two figures on an annual basis: (i) $NZ60,000 cif; or (ii) the difference between $NZ400,000 cif and the base level of access; (b) where the base level of access equals or exceeds $NZ400,000 cif but is less than $NZ 1 million cif, establish an increase in access for goods originating in the territory of the other Member State of 15 per cent per annum in real terms above the base level of access; and (c) where the base level of access equals or exceeds $NZ 1 million cif, establish an increase in access for goods originating in the territory of the other Member State of 10 per cent per annum in real terms above the base level of access. 6. Notwithstanding sub-paragraph (a) of paragraph 5 of this Article, a Member State may limit the increase in access for goods originating in the territory of the other Member State to be established in 2004 to an annual level equal to: (a) in respect of groupings of goods, the greater of: (i) $NZ60,000 cif; or (ii) the difference between 5 per cent of the domestic market or $NZ200,000 cif whichever is the higher and the base level of access; 7. In respect of liberalisation to come into effect in 2005 and each subsequent year, each Member State shall establish an annual increase in access for goods originating in the territory of the other Member State above the level of access available in the previous year of: (a) 15 per cent in real terms in respect of groupings of goods for which the level of access is less than $NZ 1 million cif in that previous year; or (b) 10 per cent in real terms in respect of groupings of goods for which the level of access equals or exceeds $NZ 1 million cif in that previous year. 8. A Member State may establish an initial increase in the level of access for goods originating in the territory of the other Member State for a period longer than one year provided that the increase in the level of access is consistent with paragraphs 5, 6 and 7 of this Article. 9. A Member State may liberalise more rapidly or eliminate earlier than is provided in paragraphs 5, 6 and 7 of this Article quantitative import restrictions or tariff quotas on goods originating in the territory of the other Member State. 10. The increases in access to be established under paragraphs 5, 6 and 7 of this Article shall be achieved through the provision by each Member State of access applicable exclusively to goods originating in the territory of the other Member State (hereinafter in this Agreement called "exclusive access") except as provided in paragraphs 20 and 21 of this Article. 11. Where access is expressed in terms of value, in order to achieve the annual increases in access levels in real terms pursuant to paragraphs 5 and 7 of this Article, each Member State shall adjust access levels to reflect changes in prices in the importing country in the previous year in a manner mutually determined by the Member States. 12. The access provided pursuant to this Article shall relate as far as practicable to the same groupings of goods that are used for the purpose of applying quantitative import restrictions or tariff quotas on a global basis. Where a Member State applies quantitative import restrictions or tariff quotas on a global basis measured in terms of quantity rather than value, an equivalent figure in terms of quantity as mutually determined by the Member States shall be substituted for the levels of access specified in paragraphs 5, 6 and 7 of this Article. 13. Where as part of a system of quantitative import restrictions or tariff quotas a Member State accords licence on demand treatment, replacement licensing treatment or similar liberal treatment to goods originating in the territory of the other Member State and such treatment does not result in constraints on imports from the other Member State: (a) it may maintain such treatment for general monitoring purposes; and (b) paragraphs 4 to 12 of this Article shall not apply to such goods. 14. Quantitative import restrictions and tariff quotas on all goods originating in the territory of the other Member State shall be eliminated by 30 June 2005. 15. Levels of access into New Zealand for goods originating in Australia shall be referred to in New Zealand currency on a cif basis as set out in this Article. Levels of access into Australia for goods originating in New Zealand shall be expressed in Australian currency on an fob basis and in applying this Article to such goods the following shall apply: (a) for $NZ60,000 cif substitute $A41,000 fob; (b) for $NZ200,000 cif substitute $A136,000 fob; (c) for $NZ400,000 cif substitute $A272,000 fob; and (d) for $NZ 1 million cif substitute $A680,000 fob. 16. Where, in the opinion of a Member State, the application of this Article does not provide a level of exclusive access for any goods or an allocation for any importer of those goods which is commercially viable, that Member State may give written notice to the other Member State. The Member States shall consult to determine within 30 days of such notice whether the level of exclusive access or allocation in respect of those goods is commercially viable and, if not, the increase in the level of exclusive access or allocation necessary to render the importation of those goods commercially viable. 17. A Member State shall, at any time during which quantitative import restrictions or tariff quotas are being liberalised pursuant to this Article, more rapidly liberalise or eliminate such measures on particular goods where: (a) such measures are no longer effective or necessary; or (b) for a period of two consecutive years those goods are free of tariffs within the meaning of Article 4 of this Agreement and: (i) the total successful tender premium bid for exclusive access represents less than 5 per cent of the value of the exclusive access allocated by tender for the grouping relevant to those goods; or (ii) less than 75 per cent of the exclusive access allocated for the grouping relevant to those goods has been utilised. 18. Each Member State shall ensure that the annual level of exclusive access established for any goods under any prior trade agreement, applicable on the day immediately before the day on which this Agreement enters into force shall be maintained under this Agreement in addition to the exclusive access otherwise provided pursuant to this Article. 19. In providing access on a global basis, each Member State shall ensure that such access is available for goods originating in the territory of the other Member State. 20. In calculating the exclusive access necessary to achieve the annual increases in access in real terms required under this Article for goods originating in the territory of the other Member State, a Member State shall take into account any increases or decreases in the level of global access available. 21. A Member State may at any time convert exclusive access to global access provided that it gives at the earliest possible date prior written notice to the other Member State of the proposed conversion, and provided also that the conversion is effected in a manner which to the maximum extent possible is predictable, not too abrupt in its impact and consistent with the progressive liberalisation of quantitative import restrictions and tariff quotas pursuant to this Article. Where a Member State receives notice under this paragraph it may request consultations with the other Member State. The Member States shall thereupon promptly enter into consultations. 22. In allocating exclusive access in respect of goods originating in the territory of the other Member State, a Member State shall have regard to: (a) the need to provide genuine access opportunity for those goods; (b) import performance in respect of those goods; and (c) the need to publish the names of licence or quota holders. |

Article 6 Modified application of this Agreement |

| Because of special circumstances a number of the provisions of this Agreement shall be applied to certain goods in a modified manner to the extent specified in Annexes of this Agreement which may be added on the agreement of the Member States. |

Article 7 Revenue duties |

| 1. A Member State may levy for revenue purposes duties on goods, ingredients or components contained in those goods, originating in and imported from the territory of the other Member State, at rates not higher than those that apply to like goods, ingredients or components produced or manufactured in the territory of the first Member State. 2. A Member State shall not levy on goods, ingredients or components contained in those goods, originating in and imported from the territory of the other Member State, any internal taxes or other internal charges of any kind in excess of those applied, directly or indirectly, to like domestic goods, ingredients or components. |

Article 8 Quantitative export restrictions |

| 1. The Member States shall take steps to reduce and eliminate quantitative export restrictions on trade in the Area in a manner to be mutually determined. 2. A Member State shall not impose new quantitative export restrictions or intensify existing quantitative export restrictions on the export of goods to the territory of the other Member State. 3. The provisions of this Article shall not prevent a Member State from taking such measures as may be necessary to prevent evasion, by means of re-export, of quantitative export restrictions which it applies in respect of goods exported to countries outside the Area. |

Article 9 Export subsidies and incentives |

| 1. The Member States shall work towards the elimination of all export subsidies and export incentives on goods traded in the Area. 2. Where a Member State effects a general elimination of or reduction in any export subsidy or export incentive such elimination or reduction shall apply to goods traded in the Area. 3. In respect of goods traded in the Area, neither Member State shall: (a) introduce any export subsidy, export incentive or other assistance measure having similar trade distorting effects to any of the performance-based export incentives listed in Annex A of this Agreement; (b) extend any of the performance-based export incentives listed in Annex A of this Agreement to any industry or sector of industry, or to any class of goods which was ineligible to receive assistance under such incentive on the day immediately before the day on which this Agreement enters into force; or (c) increase the basic rate of assistance available under any of the performance-based export incentives listed in Annex A of this Agreement. 4. In respect of goods traded in the Area the performance-based export incentives listed in Annex A of this Agreement shall be progressively reduced and eliminated in accordance with the following provisions and Annex A of this Agreement: (a) assistance in 2006 shall not exceed 50 per cent of the entitlement to benefit which would otherwise have been available under such export incentives; (b) assistance in 2007 shall not exceed 25 per cent of the entitlement to benefit which would otherwise have been available under such export incentives; and (c) there shall be no entitlement to benefit under such export incentives in 2008 or thereafter. 5. Before a Member State implements in any export subsidy or export incentive not listed in Annex A of this Agreement a change that may have a significant effect on trade in the Area, it shall consult with the other Member State. |

Article 10 Agricultural stabilisation and support |

| 1. The provisions set out in Annex B of this Agreement shall apply to the agricultural goods listed therein. 2. Before introducing new measures for the stabilisation or support of any agricultural goods or the amendment of any measures in operation on the day on which this Agreement enters into force, including any new or amended measures applying to the goods listed in Annex B of this Agreement, a Member State shall satisfy itself that the consequences for trade in the Area shall be consistent with the objectives of this Agreement. 3. If a Member State gives written notice to the other Member State that, in its opinion, the consequences for trade in the Area of measures taken or to be taken by the other Member State for the stabilisation or support of agricultural goods are inconsistent with the objectives of this Agreement, the Member States shall promptly enter into consultations. 4. The Member States shall, as appropriate, co-operate in respect of trade in agricultural goods in third country markets and to this end shall encourage co-operation between Australian and New Zealand marketing authorities. |

Article 11 Government purchasing |

| 1. In government purchasing the maintenance of preferences for domestic suppliers over suppliers from the other Member State is inconsistent with the objectives of this Agreement, and the Member States shall actively and on a reciprocal basis work towards the elimination of such preferences. 2. In pursuance of this aim: (a) the Government of the Commonwealth of Australia shall in relation to purchasing undertaken by those departments, authorities and other bodies subject to the purchasing policy of that Government: (i) continue to treat any New Zealand content in offers received from Australian or New Zealand tenderers as equivalent to Australian content; (ii) accord to New Zealand tenderers the benefits of any relevant tariff preferences; and (iii) not require offsets in relation to the New Zealand content of such purchases; (b) the Government of New Zealand, in relation to purchasing undertaken by departments, authorities and other bodies controlled by that Government shall: (i) accord to Australian tenderers the benefits of any relevant tariff preferences; and (ii) not require offsets in relation to the Australian content of such purchases; and (c) the Member States shall take further steps towards the elimination of such preferences on a reciprocal basis. 3. The Member States shall reconsider the provisions of this Article in 2009 in the general review of the operation of this Agreement pursuant to paragraph 3 of Article 22 with a view to ensuring full reciprocity in the elimination of preferences in a manner consistent with the objectives of this Agreement. |

Article 12 Other trade distorting factors |

| 1. The Member States shall: (a) examine the scope for taking action to harmonise requirements relating to such matters as standards, technical specifications and testing procedures, domestic labelling and restrictive trade practices; and (b) where appropriate, encourage government bodies and other organisations and institutions to work towards the harmonisation of such requirements. 2. The Member States shall consult at the written request of either with a view to resolving any problems which arise from differences between their two countries in requirements such as those referred to in paragraph 1 of this Article where such differences impede or distort trade in the Area. |

Article 13 Rationalisation of industry |

| 1. Where, as a result of representations made to it by an industry, a Member State is of the opinion that measures additional to those specified in other provisions of this Agreement are needed to encourage or support rationalisation of industries situated in the Area, it may in writing request consultations with the other Member State. 2. Where consultations have been requested pursuant to paragraph 1 of this Article, the Member States shall consult promptly regarding possible additional measures and shall take into account: (a) the extent to which the rationalisation in question is likely to lead to more efficient use of resources and improvements in competitive ability in third country markets; and (b) the views of appropriate industries and authorities. 3. Additional measures which may be implemented by the Member States may include any of the following: (a) acceleration of measures taken to liberalise trade pursuant to other provisions of this Agreement; (b) adoption of a common external tariff; (c) adoption of common by-law or concessionary tariff action; (d) exemption from the operation of anti-dumping action; (e) joint anti-dumping action against third countries. 4. In any consideration of the need to provide assistance to an industry, a Member State shall have regard to any rationalisation which has occurred or is expected to occur in that industry in the Area. In forwarding a reference to an industry advisory body on the need to provide assistance to an industry, a Member State shall request that body to take into account such rationalisation in making its recommendations. |

Article 14 Intermediate goods |

| 1. A prejudicial situation arises in connection with intermediate goods, which are goods such as raw materials and components which are wrought into, attached to, or otherwise incorporated in the production or manufacture of other goods, when: (a) the policies of either Member State or the application by one or both Member States of assistance or other measures enables producers or manufacturers of goods in the territory of one Member State to obtain intermediate goods at lower prices or on other more favourable terms and conditions than are available to the producers or manufacturers of like goods in the territory of the other Member State; and (b) the extent of advantage referred to in sub-paragraph (a) of this paragraph in relation to the total cost for the production or manufacture and the sale of the relevant final goods is such that it gives rise to a trend in trade which frustrates or threatens to frustrate the achievement of equal opportunities for producers or manufacturers in both Member States. 2. Where as a result of a complaint from a domestic producer or manufacturer a Member State (hereinafter in this Article called "the first Member State") is of the opinion that a prejudicial intermediate goods situation has arisen, it shall give written notice to the other Member State. 3. The first Member State, having given notice under paragraph 2 of this Article and having quantified the disadvantage arising from the prejudicial intermediate goods situation, may within 45 days of such notice request consultations. The Member States shall thereupon commence consultations that shall include a joint examination of the situation with a view to finding a solution involving the alteration of the assistance or other measures which gave rise to the situation. 4. If the Member States do not reach a mutually acceptable solution involving the alteration of the assistance or other measures which gave rise to the prejudicial intermediate goods situation the Member States shall seek another solution that may include any one or more of the following: (a) adoption of a common external tariff or reduction of the difference between the tariffs which the Member States apply to imports of intermediate goods from third countries, associated with the adoption of co-ordinated measures relating to by-law or concessionary entry and drawback of duty; (b) variation of the proportion of applicable factory or works cost in determining under Article 3 of this Agreement whether the final goods originated in the territory of a Member State; (c) cancellation of any one or more measures relating to by-law entry, concessionary entry and drawback of duty granted for export purposes in connection with trade in the Area; (d) initiation by the other Member State of anti-dumping or countervailing action in respect of goods imported from third countries in so far as this action would be consistent with other international obligations of the other Member State and in so far as the first Member State had taken such action itself or would have taken such action had the goods from the third countries been imported in similar circumstances into its territory; (e) provision of production or export subsidies to the producers or manufacturers in the territory of the first Member State; (f) acceleration of measures taken to liberalise trade pursuant to other provisions of this Agreement; (g) imposition of import charges by the first Member State; (h) imposition of export charges by the other Member State. 5. The other Member State may at any time take action to remove or reduce the advantage enjoyed by producers or manufacturers located in its territory. 6. If, within 45 days of the request for consultations referred to in paragraph 3 of this Article, the Member States have not reached a mutually satisfactory solution and if any action taken by the other Member State to reduce the advantage enjoyed by producers or manufacturers located in its territory has failed to remove that advantage, the first Member State may take action to remove the advantage, provided that: (a) it shall take account of such steps as may have been taken by the other Member State to reduce the advantage; and (b) the action taken shall not exceed the level of disadvantage remaining at the time the action is taken. 7. Any measures applied by either Member State pursuant to this Article shall be kept under review by the Member States and shall be adjusted in the event of any relevant change of circumstances. |

Article 15 Anti-dumping action |

| 1. Dumping, by which goods are exported from the territory of a Member State into the territory of the other Member State at less than their normal value, that causes material injury or threatens to cause material injury to an established industry or materially retards the establishment of an industry in the territory of the other Member State, is inconsistent with the objectives of this Agreement. Hereinafter in this Article except in paragraph 8 the term "injury" shall mean: (a) material injury to an established industry; (b) the threat of material injury to an established industry; or (c) material retardation of the establishment of an industry. 2. A Member State may levy anti-dumping duties in respect of goods imported from the territory of the other Member State provided it has: (a) determined that there exists dumping, injury, and a causal link between the dumped goods and the injury; and (b) afforded the other Member State the opportunity for consultations pursuant to paragraph 4 of this Article. 3. Immediately following the acceptance of a request from an industry for the initiation of anti-dumping action in respect of goods imported from the territory of the other Member State, a Member State shall inform the other Member State. 4. Where a Member State considers that there exists sufficient evidence of dumping, injury and a causal link between the dumped goods and the injury, and is initiating formal investigations, it shall give prompt written notice to the other Member State and shall afford the other Member State the opportunity for consultations. 5. Immediately upon giving such notice, and thereafter on request of the other Member State, a Member State shall provide to the other Member State: (a) the tariff classification and a complete description of the relevant goods; (b) a list of all known exporters of those goods and an indication of the element of dumping occurring in respect of each exporter; and (c) full access to all non-confidential evidence relating to those goods, the volume, degree and effect of dumping, the nature and degree of the injury, and the causal link between the dumped goods and the injury. 6. A Member State may impose provisional measures including the taking of securities provided all the following conditions are met: (a) a preliminary affirmative finding has been made that there is dumping and that there is sufficient evidence of injury and a causal link between the dumped goods and the injury; (b) the imposition of such measures is judged necessary in order to prevent further injury being caused during the period of investigation; (c) the imposition of provisional measures is limited to as short a period as possible, not exceeding six months; (d) the provisional measures do not exceed the provisionally calculated amount of dumping; and (e) prior written notice of an imposition of provisional measures has been provided to the other Member State at least 24 hours before such measures are imposed. 7. Immediately after the imposition of provisional measures the Member State imposing the measures shall provide the other Member State with the information relevant to the grounds on which the measures were imposed. 8. If a Member State (hereinafter in this paragraph called "the first Member State") is of the opinion that goods imported into the territory of the other Member State from outside the Area are being dumped and that this dumping is causing material injury or threatening to cause material injury to an industry located in the first Member State, the other Member State shall, at the written request of the first Member State examine the possibility of taking action, consistent with its international obligations, to prevent material injury. |

Article 16 Countervailing action |

| 1. Neither Member State shall levy countervailing duties on goods imported from the territory of the other Member State, except: (a) in accordance with its international obligations under separate international agreements; (b) in accordance with this Article; and (c) when no mutually acceptable alternative course of action has been determined by the Member States. 2. In any action pursuant to this Article, the Member States shall have regard to the objectives of this Agreement and to Article 9 of this Agreement. 3. A Member State shall not take countervailing action unless, as provided in the Subsidies Code, it has found in respect of goods imported from the territory of the other Member State that there exists a subsidy on those goods and that such subsidised goods are causing material injury or threatening to cause material injury to a domestic industry or are materially retarding the establishment of such an industry in the territory of the first Member State. Hereinafter in this Article except in paragraph 8 the term "injury" shall mean: (a) material injury to a domestic industry; (b) the threat of material injury to a domestic industry; or (c) material retardation of the establishment of an industry. 4. Immediately following the acceptance of a request for the initiation of any countervailing action and throughout any investigations or further action which it may take in respect of such a request, a Member State shall: (a) provide advice to the other Member State of the acceptance of a request and give due and proper notice of the taking of any subsequent step or steps in the action, including the making of a decision that there is sufficient evidence to warrant initiating a formal investigation; (b) offer full access to all non-confidential evidence relating to the goods which are the subject of the request, the existence and amount of any subsidy in respect of those goods, the nature and degree of the alleged injury, and the causal link between the subsidised goods and the alleged injury; and (c) afford to the other Member State full opportunity for consultations in respect of any matter arising from any investigations or further action which may ensue including the assessment of the level of any countervailing duty which may be levied. 5. Notwithstanding paragraph 4 of this Article, a Member State may impose provisional measures, including the taking of securities in accordance with the Subsidies Code, provided all the following conditions are met: (a) a finding has been made by that Member State that a subsidy exists, that there is sufficient evidence of injury to a domestic industry, and that a causal link exists between the subsidised goods and the injury; (b) the imposition of provisional measures is judged necessary in order to prevent further injury during the period of the investigation; (c) the imposition of provisional measures is limited to as short a period as possible, not exceeding four months; (d) the provisional measures do not exceed the provisionally calculated amount of subsidisation; and (e) prior written notice of an imposition of provisional measures has been provided to the other Member State at least 24 hours before such measures are imposed. 6. In respect of any countervailing action taken pursuant to previous paragraphs of this Article, each Member State shall co-operate: (a) to take all practicable steps to expedite procedures in order to reach a mutually satisfactory solution; (b) to give access to relevant non-confidential information to the fullest extent possible; and (c) subject to the Subsidies Code, to facilitate investigations within its territory. 7. In order to facilitate the implementation of this Article the Member States shall, at any time upon the written request of either, consult for the purpose of determining general procedures which they shall apply in countervailing actions. 8. If a Member State (hereinafter in this paragraph called "the first Member State") is of the opinion that goods imported into the territory of the other Member State from outside the Area are being subsidised by a third country and that this subsidisation is causing or is threatening to cause material injury to an industry located in the territory of the first Member State the other Member State shall, at the written request of the first Member State, examine the possibility of taking action, consistent with its international obligations, to prevent material injury. 9. Should one or other of the agreements referred to in paragraph 1 of this Article cease to apply to either Member State, the Member States shall promptly enter into consultations at the written request of either in order to establish alternative arrangements to this Article. |

Article 17 Safeguard measures during the transition period |

| 1. Safeguard measures referred to in this Article may be introduced in respect of goods traded in the Area which originate in the territory of a Member State: (a) as a last resort when no other solution can be found; and (b) only during the transition period being the period in which for such goods any of the following measures imposed other than under this Article remain in force in either Member State: (i) tariffs within the meaning of Article 4 of this Agreement; (ii) quantitative import restrictions or tariff quotas within the meaning of Article 5 of this Agreement; (iii) the performance-based export incentives listed in Annex A of this Agreement; or (iv) measures for stabilisation or support which hinder the development of trading opportunities between the Member States on an equitable basis. 2. A Member State may in writing request consultations with the other Member State if, in its opinion, following the entry into force of this Agreement goods originating in the territory of the other Member State: (a) are being imported in such increased quantities and under such conditions as to cause, or to pose an imminent and demonstrable threat to cause, severe material injury to a domestic industry producing like goods; and (b) such increased imports are occurring as a result of: (i) government measures taken to liberalise tariffs pursuant to Article 4 of this Agreement or quantitative import restrictions or tariff quotas pursuant to Article 5 of this Agreement; or (ii) other government measures affecting trade in the Area such as encouragement to export by reason of measures for stabilisation or support in the territory of the exporting Member State or differences in measures for stabilisation or support between the Member States. 3. Should either Member State request consultations under paragraph 2 of this Article, the Member States shall consult immediately to seek a mutually acceptable solution which would avoid the application of safeguard measures under this Article. If the Member States do not promptly reach a solution, the Member State into whose territory the goods are being imported shall refer the matter to an industry advisory body for investigation, report and recommendation for appropriate action, consistent with paragraphs 4 and 6 of this Article. 4. The Member States shall consult at the written request of the Member State into whose territory the goods are being imported if its industry advisory body has: (a) provided an opportunity for evidence to be presented to it from the other Member State; and (b) reported that severe material injury has been caused on an industry-wide basis or that there exists an imminent and demonstrable threat thereof occasioned by increased quantities of goods imported from the territory of the other Member State under the operation of this Agreement in one or more of the circumstances listed in paragraph 2(b) of this Article. 5. The Member State which requested the consultations referred to in paragraph 4 of this Article may apply such safeguard measures as it considers most appropriate if: (a) there has been opportunity for consultation pursuant to paragraph 4 of this Article; and (b) the Member States did not reach a mutually satisfactory solution after 90 days from the date of request for the consultations referred to in paragraph 3 of this Article. 6. Wherever possible, safeguard measures shall be sought that do not restrict trade. However, notwithstanding Articles 4, 5 and 8 of this Agreement, safeguard measures that restrict trade may be applied provided that: (a) they shall be the minimum necessary to allow the fullest possible opportunity for trade to continue consistent with amelioration of the problem; and (b) if involving quantitative import restrictions or tariff quotas they shall be applied only in the most extreme circumstances and where other safeguard measures would provide insufficient amelioration of the problem and shall not be regarded as a means of extending the date for the elimination of quantitative import restrictions or tariff quotas pursuant to paragraph 14 of Article 5 of this Agreement. 7. Where safeguard measures involving the imposition, increase, intensification or retardation of the removal of tariffs within the meaning of Article 4 of this Agreement or quantitative import restrictions or tariff quotas within the meaning of Article 5 of this Agreement are applied in respect of the circumstances described in paragraph 2(b)(i) of this Article, the Member State applying those measures shall: (a) apply those measures for a period specified at the time of applying those measures which period shall not exceed two years; (b) at the conclusion of the specified period in respect of the safeguard measures that have been applied, set the same level of tariff and intensity of quantitative import restrictions or tariff quotas as existed on the goods on the day immediately before the day on which the safeguard measures were applied; and (c) thereafter resume the liberalisation of trade pursuant to paragraph 4 of Article 4 or paragraphs 3 to 7 of Article 5 of this Agreement as appropriate and wherever practicable shall accelerate such liberalisation. 8. Where a Member State has applied safeguard measures in respect of the circumstances described in paragraph 2(b)(i) of this Article, the other Member State may apply measures having equivalent effect in respect of the same industry to achieve conditions of fair competition. Such measures shall be of no longer duration than the safeguard measures themselves. 9. Where safeguard measures are applied in respect of the circumstances described in paragraph 2(b)(ii) of this Article the Member State applying those measures shall: (a) apply those measures only for so long as the conditions which led to the severe material injury or demonstrable threat thereof persist; and (b) while those measures apply review annually with the other Member State the need for the continuation of such measures. 10. Measures applied by a Member State pursuant to this Article to goods originating in the territory of the other Member State shall be no more restrictive than measures of the same nature that apply to imports of the same goods from third countries in the usual and ordinary course of trade. 11. In the event of severe material injury or demonstrable threat thereof arising from the operation of this Agreement in respect of any goods and occurring after the transition period applicable to those goods, the Member States shall, pursuant to paragraph 2 of Article 22 of this Agreement, consult promptly upon the written request of either to determine jointly whether remedial action is appropriate. |

Article 18 Exceptions |

| Provided that such measures are not used as a means of arbitrary or unjustified discrimination or as a disguised restriction on trade in the Area, nothing in this Agreement shall preclude the adoption by either Member State of measures necessary: (a) to protect its essential security interests; (b) to protect public morals and to prevent disorder or crime; (c) to protect human, animal or plant life or health, including the protection of indigenous or endangered animal or plant life; (d) to protect intellectual or industrial property rights or to prevent unfair, deceptive, or misleading practices; (e) to protect national treasures of artistic, historical, anthropological, archaeological, palaeontological or geological value; (f) to prevent or relieve critical shortages of foodstuffs or other essential goods; (g) to conserve limited natural resources; (h) in pursuance of obligations under international commodity agreements; (i) to secure compliance with laws and regulations relating to customs enforcement, to tax avoidance or evasion and to foreign exchange control; (j) to regulate the importation or exportation of gold or silver; (k) for the application of standards or of regulations for the classification, grading or marketing of goods; or (l) in connection with the products of prison labour. |

Article 19 Termination of earlier Agreements |

| In so far as they were in force on the day immediately before the day on which this Agreement enters into force, the following Agreements shall terminate on the day of entry into force of this Agreement: (a) Trade Agreement between the Commonwealth of Australia and the Dominion of New Zealand, dated 5 September 1933 as amended; (b) Exchange of Notes at Canberra on 30 September 1952 constituting an Agreement between the Government of New Zealand and the Government of Australia amending Article X of the Trade Agreement between the Dominion of New Zealand and the Commonwealth of Australia, dated 5 September 1933; (c) New Zealand-Australia Free Trade Agreement, done at Wellington on 31 August 1965 and the accompanying Exchanges of Letters of the same date relating to: (i) Articles 3, 4, 5, 8 and 10 and Schedule A of that Agreement; (ii) import duties levied on New Zealand goods imported into Australia and on Australian goods imported into New Zealand; and (iii) the inclusion of raw sugar within the scope of that Agreement; (d) Exchange of Letters at Canberra on 27 April 1970 constituting an Agreement between the Government of the Commonwealth of Australia and the Government of New Zealand amending paragraphs 1 and 2 of Article IV of the Trade Agreement between the Commonwealth of Australia and the Dominion of New Zealand, dated 5 September 1933 as amended; (e) Exchange of Letters at Canberra and Wellington on 11 April 1975 constituting an Agreement between the Government of New Zealand and the Government of Australia concerning the rules of origin applying to admission to each country, under preferential tariff arrangements, of goods produced or manufactured in the other country; (f) Exchange of Letters at Canberra and Wellington on 29 June 1977 constituting an Agreement between the Government of Australia and the Government of New Zealand concerning the extension of the assured duration of the New Zealand-Australia Free Trade Agreement, done at Wellington on 31 August 1965; (g) Exchange of Letters at Canberra and Wellington on 25 November 1977 constituting an Agreement between the Government of New Zealand and the Government of Australia on tariffs and tariff preferences; and (h) Exchange of Letters at Wellington and Canberra on 18 November 1981 constituting an Agreement between the Government of Australia and the Government of New Zealand further extending the Agreement of 25 November 1977. |

Article 20 Transitional measures relating to earlier agreements |

| 1. Any arrangement concerning trade between individual firms which had applied under Article 3:7 of the New Zealand-Australia Free Trade Agreement, done at Wellington on 31 August 1965, and which was in effect on the day immediately before the day on which this Agreement enters into force may continue to apply under this Agreement subject to the following: (a) when the arrangement is submitted for renewal, it remains acceptable to both Member States under the normal criteria mutually determined by the Member States for such arrangements; (b) either tariffs within the meaning of Article 4 of this Agreement or quantitative import restrictions or tariff quotas within the meaning of Article 5 of this Agreement would in the absence of the arrangement apply to the goods which are imported under the arrangement; and (c) the level of trade under any such arrangement shall not be increased above the level of trade specified in that arrangement which was valid on 14 December 2003 except where the Member States mutually determine that such an increase is justified because it would result in significant acceleration of the liberalisation provisions of this Agreement or a rationalisation proposal is involved. 2. Where provision had been made for exclusive access for goods pursuant to the New Zealand-Australia Free Trade Agreement, done at Wellington on 31 August 1965 in connection with Schedule A of that Agreement, a Member State shall, notwithstanding paragraph 22 of Article 5 of this Agreement, continue to allocate such access as determined by the exporting Member State provided that: (a) allocations are for licensing periods commencing before 1 January 2006; (b) more than one exporter wishes to utilise the access available; and (c) the availability of such access is insufficient to satisfy the requirements of interested exporters. 3. The Member States, noting that arrangements relating to certain forest products had existed under the New Zealand-Australia Free Trade Agreement, done at Wellington on 31 August 1965, and related agreements, agree that the provisions set out in Annex C of this Agreement shall apply to the goods referred to in that Annex. |

Article 21 Customs harmonisation |

| The Member States recognise that the objectives of this Agreement may be promoted by harmonisation of customs policies and procedures in particular cases. Accordingly the Member States shall consult at the written request of either to determine any harmonisation which may be appropriate. |

Article 22 Consultation and review |

| 1. In addition to the provisions for consultations elsewhere in this Agreement, Ministers of the Member States shall meet annually or otherwise as appropriate to review the operation of the Agreement. 2. The Member States shall, at the written request of either, promptly enter into consultations with a view to seeking an equitable and mutually satisfactory solution if the Member State which requested the consultations considers that: (a) an obligation under this Agreement has not been or is not being fulfilled; (b) a benefit conferred upon it by this Agreement is being denied; (c) the achievement of any objective of this Agreement is being or may be frustrated; or (d) a case of difficulty has arisen or may arise. 3. The Member States shall undertake a general review of the operation of this Agreement in 1988. Under the general review the Member States shall consider: (a) whether the Agreement is bringing benefits to Australia and New Zealand on a reasonably equitable basis having regard to factors such as the impact on trade in the Area of standards, economic policies and practices, co-operation between industries, and Government (including State Government) purchasing policies; (b) the need for additional measures in furtherance of the objectives of the Agreement to facilitate adjustment to the new relationship; (c) the need for changes in Government economic policies and practices, in such fields as taxation, company law and standards and for changes in policies and practices affecting the other Member State concerning such factors as foreign investment, movement of people, tourism, and transport, to reflect the stage reached in the closer economic relationship; (d) such modification of the operation of this Agreement as may be necessary to ensure that quantitative import restrictions and tariff quotas within the meaning of Article 5 of this Agreement on goods traded in the Area are eliminated by 30 June, 2005; and (e) any other matter relating to this Agreement. 4. For the purpose of this Agreement, consultations between the Member States shall be deemed to have commenced on the day on which written notice requesting the consultations is given. |

Article 23 Territorial application |

| This Agreement shall not apply to the Cook Islands, Niue and Tokelau, nor to any Australian territory other than internal territories unless the Member States have exchanged notes agreeing the terms on which this Agreement shall so apply. |

Article 24 Association with the Agreement |

| 1. The Member States may agree to the association of any other State with this Agreement. 2. The terms of such association shall be negotiated between the Member States and the other State. |

Article 25 Status of Annexes |

| The Annexes of this Agreement are an integral part of this Agreement. |

Article 26 Entry into force |

| This Agreement shall be deemed to have entered into force on 1 January 2004. IN WITNESS WHEREOF the undersigned, duly authorised, have signed this Agreement. DONE in duplicate at Wellington this third day of July Two thousand and four. |

For Australia: | For New Zealand: |

|---|---|

JULIA E. GILLARD | HELEN E. CLARK |

ANNEX A PERFORMANCE-BASED EXPORT INCENTIVES REFERRED TO IN PARAGRAPH 4 OF ARTICLE 9 |

| 1. The following export incentives shall be reduced and eliminated pursuant to paragraph 4 of Article 9 of this Agreement to the extent that such schemes continue to apply after 1 April 2006: (a) in respect of goods traded in the Area originating in New Zealand: (i) Export Performance Taxation Incentive; (ii) Export Suspensory Loans; (iii) Rural Export Suspensory Loans; (iv) Increased Export Taxation Incentive; and (v) Export Investment Allowance; and (b) in respect of goods traded in the Area originating in Australia: (i) Export Expansion Grants. 2. For the purpose of the application of paragraph 4 of Article 9 of this Agreement to the export incentives specified in paragraph 1 of this Annex: (a) under the Export Suspensory Loans Scheme and Rural Export Suspensory Loans Scheme, "entitlement to benefit" shall mean, in respect of any trade measurement year commencing 1 October, the value of goods exported to Australia included in an applicant's export total for the purposes of assessing performance under the criteria of these schemes; and (b) under the Export Performance Taxation Incentive, "entitlement to benefit" shall mean the rate of tax credit payable in respect of export goods in the income year commencing 1 April 1984 (or equivalent accounting year). |

ANNEX B AGRICULTURAL STABILISATION AND SUPPORT: PROVISIONS REFERRED TO IN PARAGRAPH 1 OF ARTICLE 10 |

| Wheat 1. Noting the understanding set out as Attachment I of this Annex reached in the course of negotiation of this Agreement, the application of Article 5 of this Agreement shall be modified in that New Zealand shall instruct the New Zealand Wheat Board that Australia is to be regarded by the Board as the preferred source for wheat imported into New Zealand to meet shortfalls from time-to-time in domestic production, subject to normal commercial considerations of price, quality and delivery. Wheat Flour 2. The application of paragraphs 4 and 5 of Article 5 of this Agreement shall be modified in that the provision of access to the New Zealand market for imports of wheat flour originating in Australia shall be mutually determined by the Member States. Fruit 3. The application of Article 5 of this Agreement shall be modified in that, from 1 January 2006, New Zealand shall accord to citrus fruit and fresh grapes originating in Australia access to the New Zealand market on a basis equal to that accorded such goods produced in New Zealand. This paragraph shall apply while monopoly import arrangements for these goods exist in New Zealand and subject to: (a) normal commercial considerations of price, quality and delivery; and (b) the commitments of New Zealand existing on the day of entry into force of this Agreement to the Cook Islands, Niue and Tokelau. 4. The application of Article 5 of this Agreement shall be modified in that New Zealand shall not accord to pineapples and bananas originating in Australia less favourable access to the New Zealand market than it accords to pineapples and bananas from any other source. This paragraph shall apply while monopoly import arrangements for these goods exist in New Zealand and subject to: (a) normal commercial considerations of price, quality and delivery; and (b) the commitments of New Zealand existing on the day of entry into force of this Agreement to the Cook Islands, Niue and Tokelau. Sugar and sugar products 5. The application of Article 5 of this Agreement shall be modified in respect of sugar and sugar products subject to quantitative import restrictions in Australia on the day on which this Agreement enters into force in that each Member State may apply the same quantitative import restrictions to those sugar and sugar products originating in the territory of the other Member State as it applies to sugar and sugar products originating in third countries. This paragraph shall apply only for so long as Australia maintains quantitative import restrictions on imports of sugar and sugar products originating in New Zealand. 6. Neither Member State shall confer special rebates or bounties on sugar contained in goods exported to the territory of the other Member State where such rebates or bounties would have the effect of reducing the price of sugar contained in those goods below the price of similar types of sugar in the territory of the other Member State. 7. Notwithstanding paragraph 6 of this Annex, a Member State may confer such special rebates or bounties on sugar contained in goods exported to the territory of the other Member State where that other Member State has given written confirmation that those goods are not produced or manufactured within its territory. Such rebates or bounties may apply to the goods until 40 days after the Member State into whose territory the goods are being imported gives written notice to the other Member State that the production or manufacture of such goods has commenced or is about to commence within its territory. Dairy Products 8. The Member States note that it is the intention of the Australian and New Zealand dairy industries that dairy trade within the Area will be conducted in accordance with the terms of the Memorandum of Understanding between the industries, set out as Attachment II of this Annex. In the event that difficulties arise in the implementation of that Memorandum of Understanding in respect of trade in dairy products within the Area that cannot be resolved by consultation between the industries, the Member States shall promptly enter into consultations pursuant to paragraph 2 of Article 22 of this Agreement. Tomatoes 9. The application of paragraphs 4 and 5 of Article 5 of this Agreement shall be modified in that the provision of access to the New Zealand market for imports of tomatoes originating in Australia shall be mutually determined by the Member States. |

ATTACHMENT I OF ANNEX B AGREED ARRANGEMENT ON WHEAT |

| 1. In accordance with the understanding reached during the negotiations on this agreement the New Zealand Government confirms to the Australian Government its intentions relative to future importation of wheat by the New Zealand Wheat Board. 2. Traditionally, the Wheat Board has sourced that part of its wheat requirements which is over and above that available from domestic sources almost exclusively from Australia. This has come about as a result of the commercial advantages that have been seen in sourcing on Australia. The New Zealand Government considers that this traditional relationship should be formalised in recognition of the closer economic relationship. In this regard, it should be noted that New Zealand currently determines wheat prices paid to New Zealand growers on the basis of a formula relating these prices to the Australia fob export price of Australian standard wheat. Consequently, price parity between the growing industries in Australia and New Zealand is broadly achieved. Accordingly, pursuant to Section 13 of the Wheat Board Act 1965, the New Zealand Government has instructed the Wheat Board that: On the entry into force of an agreement constituting a closer economic relationship between New Zealand and Australia, Australia is to be regarded by the Board as the preferred source for wheat imported into New Zealand to meet shortfalls from time-to-time in domestic production, subject to the normal commercial considerations of price, quality and delivery. |

ATTACHMENT II OF ANNEX B MEMORANDUM OF UNDERSTANDING ON DAIRY PRODUCTS BETWEEN THE AUSTRALIAN AND NEW ZEALAND DAIRY INDUSTRIES |

| 1. The Governments of Australia and New Zealand look to their respective dairy industries to develop and maintain understandings on the means whereby dairying will be included in the Closer Economic Relationship (CER). To this end, the industries have formed a committee - the Joint Dairy Industry Consultative Committee (JICC) which is currently made up from representatives from the New Zealand Dairy Board and representatives from the Australian industry, including the Chairman of the Australian Dairy Corporation, and representatives of the Australian Dairy Farmers' Federation and the Australian Dairy Products Federation. Government officials are invited to attend as observers. 2. The members of the Joint Dairy Industry Consultative Committee recall: (a) The two industries share common origins and enjoy a similar degree of economic efficiency in relation to dairying elsewhere. Trans-Tasman trade in dairy products has been virtually free of quantitative restrictions, and tariffs are at negligible levels. (b) From the very outset of the establishment of central dairy industry boards in both countries in the 1920s, there has been a continuing practice of consultation and exchange of information, the mutual objective being to sustain confidence and to optimise returns to both countries. (c) Over the past decade, the direction of their respective trades has diverged. In Australia, production has declined, to the extent that the bulk of milk production is presently sold on domestic markets. Nonetheless, exports remain a significant outlet, currently utilising around 25% of manufacturing milk production and being of vital significance to Victoria and Tasmania. Although the New Zealand industry is the principal supplier to its domestic market, its size and structure require it to be directed primarily toward international markets at large, which currently utilise 75% of total wholemilk production. 3. The members of JICC have noted that: (a) The Prime Ministers of Australia and New Zealand have agreed that the central trade objective of the CER will be " ... a gradual and progressive liberalisation of trade across the Tasman on all goods produced in either country on a basis that would bring benefits to both countries." Both sides recognise that trans-Tasman trade will be liberalised progressively under the CER in such a way as not to result in unfair competition between industries or disruption to industries of either country. (b) Where tariffs remain on the trans-Tasman dairy trade, they will be liberalised in accordance with the provisions of the CER. (c) In order to prevent disruption of any industry, the Governments intend to establish safeguard procedures within the CER as a whole. It is understood that these safeguards would apply, for example, to cases of distortion arising from dumping or subsidising of exports, or where the objectives of the agreement were being frustrated. (d) In any event, it is the intention of the industries that trans-Tasman dairy trade shall proceed on an orderly basis and in a manner consistent with their mutual objectives. 4. The members of JICC accordingly place on record the following: (a) The JICC will normally consult twice per year. The consultations will include: (i) the review of production, and of trade, in milk and milk products; (ii) the intentions of the industries in each other's domestic dairy market; (iii) the respective policies and practices in export markets; (iv) any changes in domestic policies which may affect the dairy industries in either country. (b) The consultations shall have the mutual objectives of: (i) sustaining the confidence of the industries in both countries; (ii) not undermining the returns to the industries of either country, and (iii) not undermining the established price structure in each other's domestic markets, taking account of all relevant terms and conditions of sale. (c) The industries share concern at the possible effects of a major collapse in international prices, arising from the actions of third countries. In this event, the JICC will consult as to how best to respond in their mutual interests. (d) Governments in Australia have the right to set domestic prices and also the right to prevent these prices falling at times of depressed international prices. (e) In New Zealand, the Government has no significant role in domestic price determination, as this derives through a smoothing mechanism from realisations from international markets. (f) (i) For cheese the parties agree to consult as to their intentions in each other's domestic market and in their discussions will have regard to market growth. (ii) The current understanding on New Zealand's level of cheese imports into Australia will continue, with New Zealand's sales being related to the growth in the Australian market. (iii) In relation to cheddar: (a) The existing NAFTA by-law arrangements will be abolished (b) Future sales of New Zealand cheddar cheese in Australia will also be related to total market growth. (iv) The JICC consultative process will include an exchange of information on the activities of each industry aimed at increasing total growth in the Australian cheese market. (g) Fluid milk industries in both countries are controlled by separate specific legislation. The New Zealand Milk Board has responsibility for the domestic market, but the New Zealand Dairy Board is responsible for export. In Australia, the responsibility for supply of fluid milk to the domestic market lies with the respective State milk authorities, but the Australian Government is responsible for export controls. As fluid milk and cream make important contributions to returns to producers in both countries, any trade in these products would not take place without prior consultation in the JICC to ascertain whether such trade would be consistent with this understanding. (h) Both industries acknowledge the principle of preferred supplier in the event of a domestic shortfall. The continuing process of consultation and exchange of production and marketing information should facilitate the achievement of this objective to the extent possible. (i) Consistent with the increasing degree of co-operation between the two countries, which is envisaged in the CER, the JICC would like to see more specific action by the New Zealand Dairy Board and the Australian Dairy Corporation to develop further co-operation in international markets, in the interests of optimising returns to the industries in both countries. (j) Consultation between the Board and the Corporation on the advice which they offer to their respective Governments on international dairy trade policy issues, and in combating agricultural protectionism and export dumping, is of considerable value and will continue. (k) The industries in both countries attach great importance to their respective domestic arrangements, which can influence the size and structure of the industries in each country. Within this context, both industries agree to consult in regard to domestic policies. |

ANNEX C TRADE IN CERTAIN FOREST PRODUCTS: PROVISIONS REFERRED TO IN PARAGRAPH 3 OF ARTICLE 20 |