- Jul 12, 2018

- 10,574

|

UNITED STATES DEPARTMENT OF THE TREASURY |

|

PUBLIC |

TREASURY BACKED SECURITIES

What is a Treasury Backed Security?

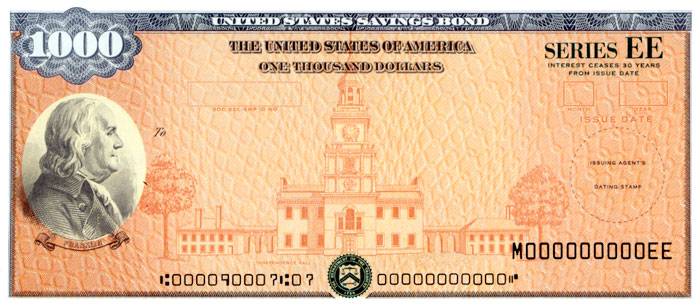

A United States Treasury Backed Security is a bond that allows the federal government to raise money without raising taxes. These securities effectively act as loans which are issued by the federal government and paid for by another country, organization, or an individual.

What are the benefits of a Security over a traditional loan?

A Treasury Backed Security has numerous benefits over a traditional loan, especially for the purchaser. Firstly, Securities are "marketable" to the rest of the world and secondly all legally issued Securities are backed by the full faith and credit of the United States of America. This means that the United States will take all legal options possible to repay Securities when they mature. The United States has never defaulted on a Security.

Why are Securities "marketable" and what does that mean?

A traditional loan is only between two individuals - the individual requesting money, and the individual who issues the money in return for a future repayment. A Security can act just like a traditional loan. However, the individual who issues the money sometimes needs the money they leant out before the loan they gave matures. A Security is "marketable" because the individual who issues the money can sell the Security (which is printed on paper) to a third party. The United States only promises to repay the holder of the physical Security, which must be returned to the United States in order for repayment to occur.

How do I sell a marketable Security?

The Department of The Treasury requires that the owner of a Security inform the Treasurer of the United States, in writing, that the Security is being sold (or transferred) to another entity or person, and also requires to know who or what that person or entity is.

Who can purchase Securities?

Any country, organization, or individual may buy Securities from the Treasury Department with the exception of countries who are at war with the United States (or organizations or individuals within countries who are at war with the United States). However, the United States may refuse to sell securities to any country, organization, or individual with or without reason.

Last edited: